Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

I am the guy who wrote Alpha Trader, the popular trading book. I’ve been trading and writing about markets since 1995. I’ve been a Managing Director, hedge fund portfolio manager, and senior risk taker at a bunch of banks on Wall Street. I made $50 million for Lehman Brothers in 2008 and you can guess how big my bonus was that year if you know much about recent financial history. And I love to write. Follow me on Twitter here.

The About page for Friday Speedrun is here.

And https://twitter.com/ross_justin_d is a contributing editor.

The idea is to keep you up to date on what matters in finance and help you level up your knowledge of global markets. With minimal exertion. For free.

If you’re a student, you’re newish to finance, or you’re just a curious life-long learner person… You are in the right place. The main body of Friday Speedrun should take about five minutes to read if we’re doing this right.

Here’s what you need to know about markets and macro this week

Global Macro

The big story of the week was evidence of an economic slowdown in the United States. China’s reopening is humming along in the background but it’s barely part of the narrative right now. This week, it was all about American data. We got a ton of US data and most of it was soggy.

When you’re looking at economic data, it’s important to ask three questions: Is the data timely? Is it accurate? Is it noisy? I threw an appendix at the end of today’s piece so that A) You can learn more about this if you like and B) I can keep the main text under five minutes. See the very end for the Appendix. You don’t need to jump there now. Read it after. If you want to.

If we want timely, accurate, and not-too-noisy US economic data, what do we look at?

ISM and Initial Jobless Claims are the best. You could just look at these series and get a pretty good idea of how the US economy is faring. ISM stands for Institute for Supply Management. It’s a monthly survey that captures the vibe of senior business leaders.

Initial Jobless Claims tell you simply how many people are applying for unemployment insurance. It comes out every week and it’s generally accurate and not too noisy. ISM comes out the first week after the month it’s describing. It is a bit noisy but it’s so timely and leading, the bit of noise is worth it.

Here’s how they look right now. There are two ISM series: Manufacturing, and Services. The ISM is simply a survey where they pretty much ask senior business managers “How you feelin’ this month compared to last month?”

If everyone says “Worse!” ISM would be zero. If they all said “Better!” it would be 100. Therefore, anything above 50 is considered positive for growth.

ISM Services and ISM Manufacturing post-COVID

And here’s Jobless Claims.

Continuing Jobless Claims, January 2021 to now

Things are gradually getting worse. Does this mean the world is ending? No. But these things trend and the trend is not great. You might think that the bounce in Claims is small, but Initial Claims trends for years sometimes. When it turns, it’s usually meaningful.

The other important labor market data this week (JOLTS, ADP, private data from LinkedIn and others, and NFP) point to a slowing labor market, but not some sort of imminent shitshow.

The jury is still out on whether we get a soft or hard landing but as credit conditions tighten after the fall of Silvergate and friends, the economy is not at cruising altitude anymore. The engines have stalled and we will soon find out whether Powell is the Sully Sullenberger of central banking.

Most people doubt it, but then again, humans are biased toward negativity because it sounds smarter.

Stonks

The story in the stock market is big tech is imitating Icarus and the rest of the market is soiling the sheets. Non-professionals tend to watch the indexes and assume “That’s what the stock market is doing” but when a few stocks dominate an index, the index barely has meaning.

Same thing when one sector is flying while the rest of the market is sucking wind. Here’s the ratio of the NASDAQ (mostly tech) vs. the Russell 2000 Index (mostly smaller public companies).

QQQ/IWM ratio

Looking at the internal performance of various sectors, instead of the big indexes going up and down is often referred to as “looking under the hood.” Try to do that. You will know a lot more about what is going on that way.

Microsoft (MSFT) and Apple (AAPL) make up more than 13% of the S&P 500. That’s right, two stocks are 13% of a 500-company index. That’s the highest since 1978, back when IBM and AT&T ruled the world.

"While it sounds like a Twilight Zone comment to many investors, tech stocks have become the new safety trade with big tech names a major beneficiary of this dynamic," Wedbush analyst Dan Ives said in a recent note.

Pro tip 1: When people say something is a “new safe haven” your first thought should be “That’s probably bullshit.”

Here’s how you did if you bought IBM at that time. Great companies and great stories can often be terrible investments.

IBM common stock, 1978 to 1982

Pro Tip 2: If you see your favorite stock or asset class on the cover of a mainstream magazine… Be afraid. That is very often a sign of a top.

Here’s an explanation of why mainstream magazines are an excellent reverse indicator. This is not investment advice and nothing works every time. Good economic forecasting and excellent trading both rely on probabilistic, not deterministic thinking.

14-word summary of this week’s stock market action:

Tech is happy, the broad market is sad, and regional bank stocks are roadkill.

KRE is the regional bank ETF and it looks like a classic dead cat bounce.

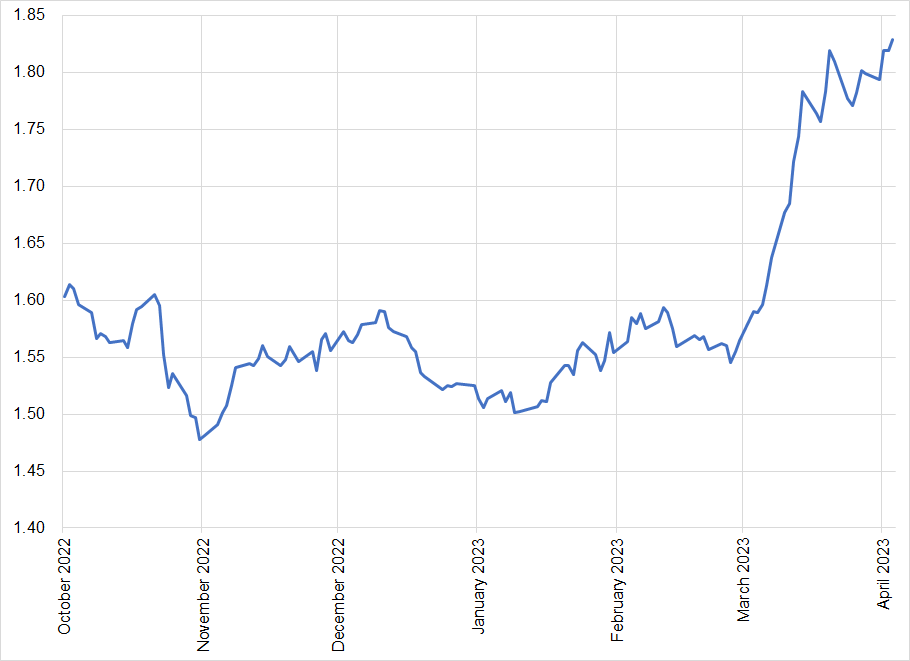

KRE, the regional banks ETF, hourly back to mid-2022

Bonds

Higher interest rates are sucking money into money market funds and bonds.

Money market funds are an extremely safe and boring place to put your money. When yields are low, you don’t want your cash in money market funds, but at 4% or so, you could do worse!

Total money market fund assets (USA)

Fiat Currencies

I love FX trading so much, I made a hoodie.

But I will admit there isn’t all that much going on this week in currency markets.

The big theme was a nonsense fear porn narrative that appears every year or two: Dedollarization.

I won’t get deep into it here, but let me just say: If you are making a list of the 350 most practical things to care about in economics and financial markets… The demise of the US dollar and the end of US hegemony should not be on that list. Sure, over the next 100 years, the USD might decline in status. But no investment or trading time horizon goes out that far. And this has been a boogeyman since I started trading in 1995. Don’t get sucked in.

I could give you an example of dollar doom porn for every year from 1995 to now. Here’s one from 2004. Note they use the same arguments and the exact same words people are using now.

The gradual erosion of fiat due to loose policy required to fund large deficits is a thing. Dedollarization is not.

For more on this topic, read my full essay on why Dedollarization is Not a Thing.

Or, listen to me offer up the TLDR in this 3-minute video.

The end of the US empire is a multi-decade or multi-century structural story and is totally irrelevant on pretty much any trading or investing time horizon. The external value of the dollar is cyclical and has remained steady despite perennial dollar doom.

Dollar doom is fear porn engagement bait. Be rational.

Crypto

Crypto is a high-beta NASDAQ proxy.

What does that mean? It means bitcoin and the NASDAQ go up and down together, but bitcoin is more volatile so when you see breathless headlines like “bitcoin is top asset of 2023” … It’s true!

But it’s mostly just because bitcoin is more volatile than the NASDAQ.

Bitcoin (black line) and NASDAQ (blue line) back to 2022

This doesn’t mean crypto isn’t more fun than a stock index. It is! The stories are way cooler. But for now, if you want to know what bitcoin is doing on any given day, just look at the NASDAQ and you will have your answer. This is not an absolute truth, of course. Sometimes they diverge as you can see in the chart.

Crypto = NASDAQ might not be true forever, but it’s been rather kinda fairly somewhat true for a long time.

This is not a criticism of crypto. Crypto is an excellent, super high-beta hedge for loose monetary policy. I am structurally bullish crypto. The market thinks that the Fed is about to reopen the liquidity spigots, so crypto is going up—in tandem with tech stocks.

This observation makes some people angry, I know. Sorry if I made you angry there. Listen to your breathing. Listen to your child breathing.

Commodities

The big story this week in commods was: OPEC cut production. This is probably a Saudi middle finger to the USA and it’s interesting that the gap higher in price has held so far. The news came out on the weekend, and oil closed at $75 last Friday and opened at $80 Sunday night. See here.

Traders always keep an eye on gaps. The longer this gap holds, the more bullish it will be for oil. We have mostly been in a 72/83 equilibrium zone for the past 6 months, so above $83 will get people more excited.

Oh, and gold almost got to the all-time high of 2080. But not quite.

That’s it for this week.

Get rich or have fun trying.

I hope you enjoyed this First Edition of Friday Speedrun. If you have any feedback, criticism, or questions, drop them in the comments. We want to make this thing better every week.

Please tell all your friends that if they don’t sign up for Friday Speedrun, you won’t be their friend anymore.

Links of the week

Neat / Sweet:

Smart / Funny:

https://twitter.com/0xDesigner/status/1642554817590566915?s=20

Smart / Interesting:

Dumb / Funny:

https://www.reddit.com/r/DnD/comments/1292k54/my_players_wont_play_unless_they_are_shirtless/

Music

Ideal at loud volume while driving fast.

.

Appendix

More on timely, accurate, and low-noise economic data

I said at the start that useful economic data is timely, accurate, and not too noisy. Here is what that means.

Timely means you’re not looking at something from, say three months ago. For example, Canada GDP released on March 31, 2023 is for January 2023. That is not particularly timely. In the US jobs data, Initial Claims are timely (weekly) while the Unemployment Rate is lagging. The Unemployment Rate is usually at its lowest point in the early part of a recession because it’s so laggy.

US Initial Jobless Claims vs. US Unemployment Rate

Note how the blue line (Initial Claims) always turns at the same time or (mostly) earlier than the Unemployment Rate. If you care about where the economy is going, follow the timely data, not the lagging data.

Accurate means the number doesn’t get revised too much later. Most economic releases have an initial release and then they get revised later. If the revisions are huge compared to the initial release, that means the release is not very accurate. Another type of data that is not accurate (generally) is data that is not seasonally adjusted. This chart of container deliveries, for example, was making the rounds this week. It looks bad! It probably is bad. But you have to think about the seasonality before you draw any conclusions.

Los Angeles container deliveries (monthly) 2004 to now

Noisy means the standard deviation of the data is high. It can be up a grillion one month and down even more the next. Here’s a chart of the household survey of US jobs, for example.

Monthly change in US jobs (household survey)

Yet you will still see commentators and forecasters mentioning that release if it fits their bias.

This is great Brent, thanks for going over this stuff! Helps especially for those that don’t work directly in finance/trading. So much information out there on the web, the issue is misinformation. But I know a handful of people, including you, that can explain the necessary but complex topics in a concise and brief manner. Thanks again and can’t wait to see more of these Friday Speedruns!

Loved the format Brent. This gives everything to know at a glance and based on interest we can then expand accordingly. Looking forward to more of this....On a side note, I have also picked up your book, the art of currency trading. Amazon reviews says that if you had to read only one book on currency trading, this is it....so fingers crossed :)