Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

The Alpha Trader audiobook is now available!

Get a free, 15-minute preview. A fun and exciting story about one of the craziest trading days of my career. Also, we’re going to pick 10 random names to receive the whole audiobook for free.

If this sounds good, hit me up here:

https://www.spectramarkets.com/alpha-trader-audiobook/

Or, just buy the whole audiobook here!

Paperback, Kindle and hardcover versions are here. The softcover price just dropped 25% to $29.99.

Here’s what you need to know about markets and macro this week

Global Macro

This was an exciting week with NVDA dominating coverage into and after earnings, as it traced out a classic good news / bad price reaction combined with a textbook gap and trap on the open and a slingshot reversal through and back below the all-time high.

NVDA, 5-minute candlestick shart

When every analyst in the world raises their estimate on a stock two days before earnings, the stock rallies 15% on thin air that day, and the stock is already wildly popular and trading at 36X sales… These are the kinds of accidents that can happen.

My view on “good news/bad price” is that it’s a meaningful setup, but it has a short half-life. That is, it’s bearish for a day or two, then it loses its importance and life moves on. I’m never going to be bullish a stock that trades at 35X earnings because probabilistically those stocks are always bad bets in the medium run. Sure, bad bets sometimes pay off. But they’re still bad bets. But going home short today could be a trap as the bears are a bit feisty and overconfident after this sharting of the bed price action.

I guess all this text belongs in the “Stocks” section, not the “Global Macro” section but this week’s NVDA earnings release was a macro event. The entire market keyed off it and even stuff like AUDUSD traded like all those Aussies do down there in Australia is manufacture and export graphics cards.

Other than NVDA, the big story was the Fed and yields. Jackson Hole was highly-anticipated and after last year’s hawkish speech that rekt markets, recency bias suggested the path of least regret into this confab was specs would position for another hawkish outcome.

Opinions vary on the actual result, but my view is that Powell just tossed a standard pitch, right down the middle. No curvature or ball movement, just the exact thing everyone expected, or close enough. More on the Fed and yields in the “Bonds” section, which I’m going to rename “Interest Rates” because 60% of the time I’m talking about monetary policy in there, not bonds.

Stocks

So yeah, NVDA.

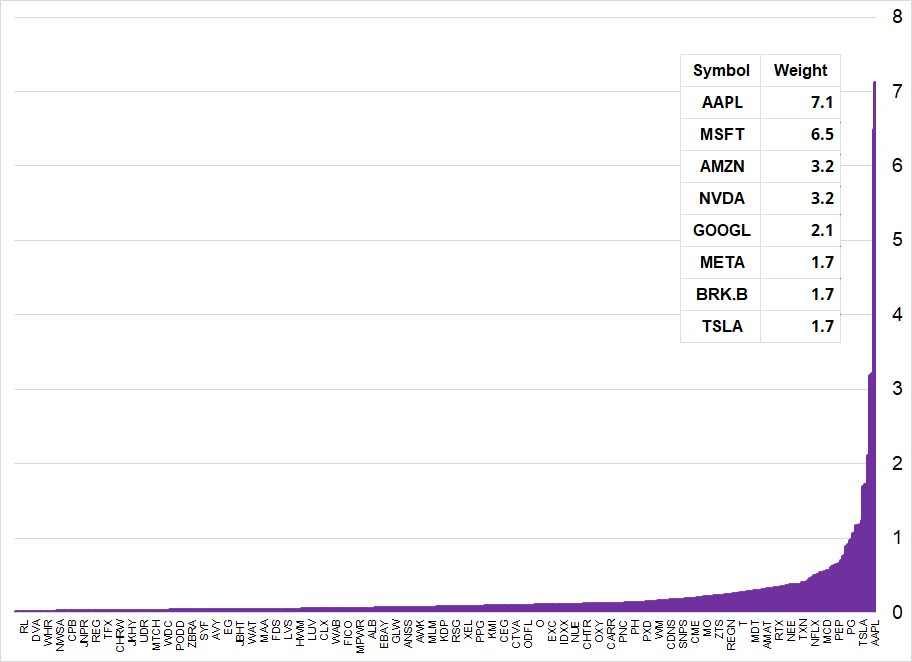

While all anyone talked about this week was NVDA, there are 499 other stocks in the S&P 500 and they are probably jealous of all the attention focused on AI. That said, the top 8 are rather dominant these days as we remain in a 2000-style era where information technology is massively overweight in the index and everything else feels like a rounding error.

S&P 500 components

(x-axis can’t show all the names cuz font size)

These mega sector overweights almost always end in sadness for bag holders but they can persist for years. And you are more likely to get fired for missing your benchmark underweight than fired if it all goes Pete Tong one day. In the latter case you just say: “Hey, everyone got smoked! Nobody could have seen it coming!” This is the ongoing tension that creates a nearly-impossible metagame for long-only tech funds and benchmark huggers. Even if you think tech is expensive, the career metagame is tilted toward plugging your nose, staying long or overweight, and hoping for the best.

And when you see a table like this one, you just close your eyes, plug your ears and say “la la la la”. Chart reads right to left for some reason.

Oil was hot in 1980, then Japan in 1990, then tech in 2000, then China, now tech again. There is much evidence that shows investing in the most gigantic companies is bad medium-term risk/reward but whatever. You get the point.

With regard to the 499 bridesmaids and NVDA, the chart is looking spicy here.

S&P 500 Index hourly back to March 2023

Everyone was freaking out about Silvergate and all that in March and then the shorts were subsequently buried by a slow and painful rally that accelerated on June 13 as the US released a soft CPI figure. On the chart, you can see that the June 13 NewsPivot has become a huge level as we gapped through it on CPI day, retested late June, retested again on August 18, and are now within a well-struck 4-iron of landing there again.

If you’re bullish stocks, a daily close below 4310 in SPX is a massive red flag.

Here is this week’s 14-word stock market summary:

Even trees that crush earnings expectations cannot grow to the sky. Keep watching yields.

Interest Rates

US yields are tickling really, really important levels. Here’s the 2-year yield as it sniffs at, but has not yet broken the July high.

US 2-year yield, hourly back to late June 2023

And the US 10-year yield made a new high but then failed, putting in a false break, also known as a slingshot reversal. I find it weirdly fun to reference that Slingshot Reveral link because I wrote the article in 2007 and got paid $282 for doing so and it is still a reasonably concise piece of explanatory writing. I am proud of my 34-year-old self for writing that one. I still have the physical magazine copy. Seeing your name in a physical magazine is a weirdly thrilling thing, even at the tired old age of 34.

Remember magazines? Those were neat. Do they still exist?

Anyhoo. Here’s the 10-year yield.

US 10-year yield, daily back to August 2022

This is certainly not a decisive rejection, yet. But it’s interesting. My view for the past 8 weeks or so has been for higher yields, but I think we’re topping out now. Markets are forward-looking and here’s what they’re going to be looking at going forward:

Resumption of student loan payments

US government shutdown

Wonky pressure on California taxpayers

Disinflationary winds from China

Disinflationary winds from Europe

Gradually normalizing jobs market

I think the move in yields has now become more about technicals, supply, convexity hedging, and idiosyncratic stuff that never lasts. When you zoom out, future growth and inflation are the dominant driver of bonds and everything else operates on the zoomed-in fractals. Speaking of bonds, check out my music choice this week which is a deep cut of Radiohead doing a 1977 James Bond theme.

Fiat Currencies

For 10 days or so I’ve been thinking that the USD is going to turn lower and gold would rip higher, but while gold is working a bit, the USD refuses to do my bidding. FX is hard. Here’s my thesis:

Yields are topping out as explained above. Techs and fundamentals align, IMO.

Seasonality for the USD is very strong in August and the month is basically over.

Bearish China sentiment is wildly extreme. This week every time I walked past the TV at the elevator, the word China was on the screen via Bloomberg TV. Every email I get has the word China in it. It feels like I’m watching this video! Incidentally, that video is a great example of how a really simple idea with good editing can deliver megalols.

Besides my anecdotal observations and the fact that my inbox is overflowing with China-negative emails like the Ganges in monsoon season…

There’s this! Another cover from The Economist. Xi riding a snail! C’mon. This is straight out of a behavioral finance textbook.

The reasons I think the level of China bearishness is super sus is:

We have been playing a game of Pong with China sentiment. Raging bullish in January, tepid, then bullish again, then tepid, now “It’s CoLLaPsiNG!” It all feels a tad ridiculous. China’s structural problems are well-known and will continue to create a sucking sound there, but it’s not like “China is Japan!” is much of an actionable observation. The irony is that the world is hating on China just as they abandon endless debt-fueled stimulus and embrace Shumpeter’s Creative Destruction while the world loves the centrally-planned government stimulus-driven results of the US 2021 experiment. Not tradable, but definitely ironic. Don’t you think?

Covers of The Economist have a demonstrated track record of working as an excellent reverse indicator.

If China had entered an accelerating phase of economic collapse, copper wouldn’t be up here. BHP, FCX, and WDS (Australian commodity exporting stocks) would not be trading strong. Nothing in the cross-asset scan suggests China is much different now than it was a few months ago. Evergrande and Country Garden are slow burners; we have been talking about Evergrande as China’s Lehman moment since 2021!

My fourth reason for USD-bearishness is that the People’s Bank of China is capping USDCNH (USD/yuan) and they tend to win. If USDCNH stabilizes here, it’s bearish USD.

Gold has traded well in a world of skyrocketing real rates. If yields stabilize, gold should rip. Also, I’m a big fan of trading breakouts from falling wedges because they offer high-leverage setups with some edge on timing. Gold options are cheap as heck and the falling wedge resolved higher. Chart of gold in the section on commods.

.

I am staying bullish gold and bearish USD but I’m scared.

Crypto

Bitcoin, like many other products in the world, is testing a key level. Remember when bitcoin was 25000 and Balaji made that absurd and hysterical bet that the world was gonna end after Silvergate bank went under? Well, that area has been a crucial pivot, before and after as you can see here:

BTC 4-hourly back to late 2021

Trading volumes remain subdued but as long as 25k holds in BTC and my USD lower / gold higher view comes true… Maybe longs are going to be alright. A daily close below $25,000 and I would use my imagination on what could come next. Like… $17000? For now, the setup is still bullish as BTC continues to survive, if not thrive. Dead money for now but it’s not costing you much and when the US announces its $10 trillion stimulus program during the Great Recession of 2025 and BTC goes to $100k, you’ll be glad you HODL’d.

Commodities

As promised a few paragraphs earlier:

Gold hourly back to late July

Oil is doing nada, and RBOB is holding in OK but has lost momentum. Cattle futures at the highs. Lumber and wheat at the ding-dong lows. Mixed bag.

Alright. That was 5.74 minutes. You’re done. Please hit the like button to trigger author’s dopamine release.

Get rich or have fun trying.

Links of the week

Intelligent vs. Smart

https://collabfund.com/blog/intelligent-vs-smart/

Me, excited

https://twitter.com/donnelly_brent/status/1695048128573952049?s=20

Advice for 22-year-olds (from Jack Raines)

https://www.youngmoney.co/p/advice-22yearold-just-getting-started

Advice for kids heading to college (from me)

https://www.epsilontheory.com/before-you-fly-the-nest-advice-for-kids-heading-to-college/

Music

Thom Yorke, fearlessly covering Carly Simon. "Nobody Does It Better" is a Carly Simon power ballad and the theme song from the James Bond film The Spy Who Loved Me (1977).

I’m arguing that the two largest foreign investors in American government debt, holding $2T of securities, are net sellers and your argument is that auctions have been solid. Ok…

Besides, I would expect auctions to be bid at these levels anyway for a technical bounce. I understand that inflection traders will be all over it too.

Brilliant writing and analysis of the market as always. Thank you very much!