Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Global Macro

Worries about overvaluation, rising volatility, poor seasonality, a less dovish Fed, rising inflation, NVDA channel-stuffing FUD, and twin solar flares were not enough to keep stocks down this week as NVDA crushed earnings and left the bears scuffling. Stock markets around the world are making new all-time highs all at once as money flows in and fear flows out.

Even the beleaguered Nikkei cracked the ATH this week, finally allowing anyone who bought in 1990 to show a profit.

While that tweet is hilarious, it’s worth noting that stocks also earn dividends. It’s one of many reasons it’s really, really hard to short stocks in aggregate. Here is the total return of the Nikkei (including dividends) back to the day I was born.

Nikkei 225 Index Total Return, 19SEP72 to now

The longer you hold something, the more the carry matters. That’s why gold is generally a drag on portfolios. It needs to go up 5%/year compounded just to break even with current t-bill rates. That’s why MXN is so popular right now. USDMXN is trading at 17.11, but if you sell it one year forward, you’re short at 18.08. Day traders and short-term punters don’t need to worry about carry but investors do. The magic of compounding is real. Then again, no amount of magical compounding or patience could help you if you bought Nikkei in 1990 thinking that Japan was going to surpass the USA soon.

The fear of Japan in 1990 is very much like the fear of China in 2024.

Stocks are on the rampage, the soft landing is here, and everything is awesome.

The Fed used Waller to tee up rate cuts last November, but the market got too excited and priced in 7 cuts when the Fed only saw 3. The Federatti has been doing frantic PR since then and finally got the market to come into line with the dots. Obviously the Fed got some help from the data, too, as it remains characteristic of a mild acceleration out of a mid-cycle slowdown. Sentiment is improving, the jobs market is strong, and inflation is lower.

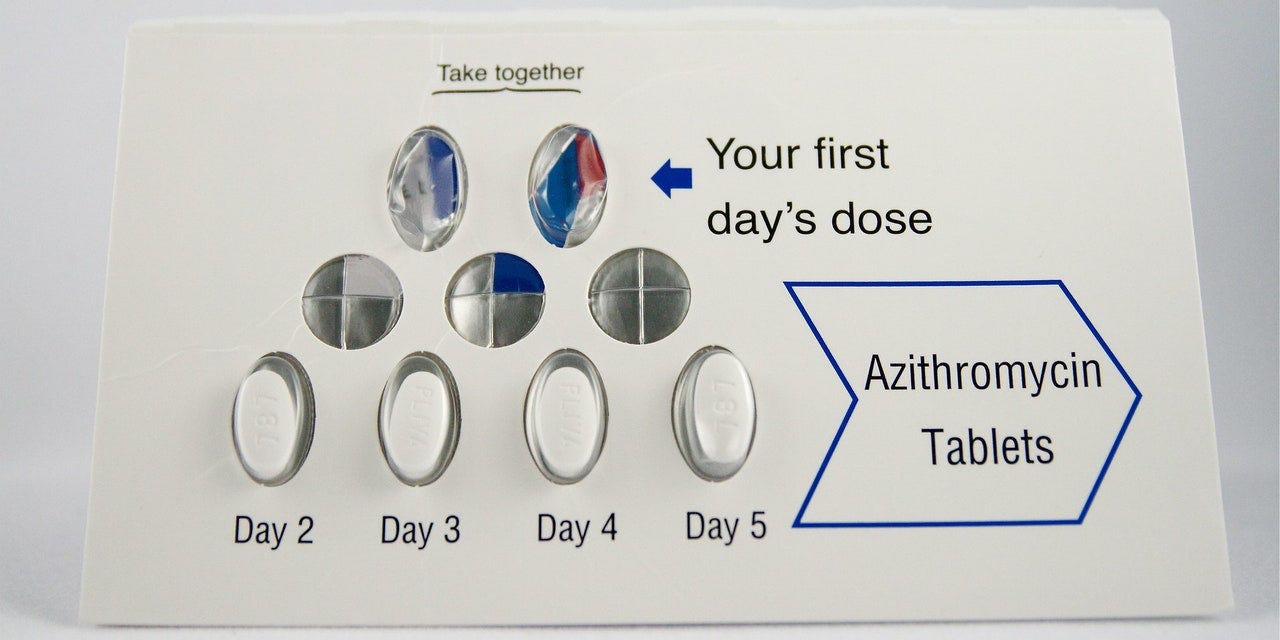

The January data is full of distortions, so it’s a bit early to worry about higher inflation from here, but the uptick is a bit worrisome. If the Fed thought the last mile of inflation reduction was going to be the toughest, they’ve scored an own goal here by turning dovish so early before the fire has fully been extinguished. They are doing the equivalent of taking the penicillin for 3 days because things feel better, instead of following the instructions on the packet and completing the full 5-day dose.

Due to their desire to rush back to neutral, they are lighting a fire under inflationary forces again as housing is near the highs, wages are strong, the jobs market is still fine, and nobody has a clue where r-star is plus or minus 2.5%.

Targeting an unobservable, procyclical variable is going to prove to be the wrong strategy, in my opinion, but until there is strong evidence of a meaningful inflation rebound, party on, Wayne. I don’t think the market will be able to look through a strong February CPI print. If that happens, risk premium will reprice in all markets.

AD

am/FX is my daily macro note that goes to a couple of thousand traders and investors. Learn more, faster. Subscribe here.

END OF AD

Stocks

A powerful mix of Goldilock economic figures, unprecedented operating margins, and speculative frenzy have whipped us to new highs for the SPX and NASDAQ. While it feels frothy as heck, this is what bull markets generally feel like. They climb the wall of worry as the pessimists point to various metrics of overcookedness while the trend followers and the optimists bank the lucre.

If you drew a line off the 2024 open for NVDA and extrapolated 1.4% per day of growth (about the same as the Nikkei annual divided, FWIW!), you get a red line like the one in this chart.

NVDA stock (actual in black) vs. 1.4% daily growth

You can see NVDA got away from the trend as earnings worries and fear of an SMCI collapse triggered about 60 hours of anxiety before the bears had their souls removed from their bodies in post-market trading Thursday. The whole market was leaning left just as NVDA went hard to the right, leaving a large gap in SPX, too.

There have been 11,147 trading days since 1980, and today’s gap was the 108th largest ever. Large but not historic. The graph of data like that is cool if you sort it from largest to smallest.

S&P close-to-open gaps sorted largest to smallest, 1980 to 2024

Here is this week’s 14-word stock market summary:

NVDA NVDA NVDA NVDA NVDA NVDA NVDA NVDA NVDA NVDA NVDA NVDA NVDA NVDA

Interest Rates

At the start of the year, the market was pricing between 6 and 7 rate cuts and just about everyone thought that was excessive. Now, we’re pricing 3.

Fed rate cuts priced for December 2024

So I guess that means everyone made tons of money right? Well, it’s not that simple. Fed rate cuts are partially the price of a possible meltdown in stocks. So if you are paid SOFR (betting on fewer cuts) you are synthetically short an S&P put and this can be very difficult to risk manage. For example, here’s what SOFR did when Silvergate went Tango Uniform.

Getting the direction of a trade right is a small part of successfully making money in markets. You also have to size the trade large enough to make real money but small enough to survive if it blows up. This is a ridiculously difficult calculation to make and it usually starts with backward-looking analysis of historical volatility. If you think SOFR is going to move 14bps / day, you use that as an input to determine how many contracts (or calls) to short. But if it then starts ripping 42bps / day and you’re short calls. No bueno.

Anyway, playing for the Fed to cut less than 6 times looks easy in hindsight, and might have even looked easy in January 2024. But selling options is easy when it works and it’s really hard when it doesn’t. Many don’t appreciate how their directional bets are actually synthetic derivatives due to spot/vol correlation.

I’m sorry that got kind of wonky. I hope this makes you feel better.

Fiat Currencies

FX is hard. Nobody has ever once said it isn’t. The only thing working right now is long carry (USDMXN short, USDJPY long, etc.). I was talking about carry earlier, so let me show you the difference between USDMXN, the currency, and the total returns from USDMXN. Remember that USDMXN is just the price of the currency exchange rate on any given day. But if you own MXN, you get bonus interest because Mexican rates are way higher than rates in the US.

The Mexican peso has been even more caliente than it looks

If you bought MXN in 2021 or 2022, nice job. It’s been one of the best currency trades.

The only other theme in an FX market lacking themes has been weakness in the Swiss franc. Inflation in Switzerland is low, and the central bank could cut rates as early as March. They could also go to a currency selling program at some point, though their credibility on currency management is gossamer-thin.

Crypto

For anyone who doesn't already know this: Bitcoin is essentially the same thing as triple-levered NASDAQ. TQQQ is the 3X NASDAQ ETF. Here, I compare how the two have behaved since 2019. They are twins, but not identical.

You can see they diverge here and there. They're obviously not identical. But have been close to functionally equivalent. If you're a trader or an investor, they are doing the same thing for you.

I find this interesting because the narratives are so different and yet the price action reflects that both are liquidity thermometers and you can debate the future of money, or the importance of AI chips, or NVDA valuation, or whether or not bitcoin is useable as a peer-to-peer currency. But I could easily argue that none of those things are relevant and they are tied at the hip because they both represent a combination of how much money is searching for a home, and how risky people are feeling.

Perhaps even more interesting is that a portfolio combining TQQQ and BTC delivers better risk-adjusted return than either on their own because they are not as correlated as you would think even though the big moves coincide. Maybe one day they will diverge, but waiting for that to happen is like waiting for the Bigfoot Recssion of 2022 2023 2024 2025.

An underappreciated point in the ongoing war between the crypto believers and the haters is that stablecoins perform many of the desired functions of cryptocurrency, but without the extreme volatility and speculation of BTC and other tokens. If you live in a country with high inflation and you need protection and/or a way to send money without much friction, stablecoins are your answer, not bitcoin.

I understand that bitcoin is thought of as a hedge against general fiat debasement, and I agree. But USD fiat debases very, very slowly and almost any asset you buy is going to hedge you against fiat debasement anyway. As mentioned above, TQQQ and BTC are effectively the same asset over the past five years. BTC just gives you a high-vol way to do it with a lot more on-ramping and transaction fees. And if you live in Africa, or Argentina, or Turkey, and you want to protect your earnings and savings so that you can exchange them for goods and services or send them to someone else at a later date, stablecoins are the way. BTC for show, stablecoins for dough.

This tweet from ex-NFLer Rusell Okung captures it:

https://x.com/russellokung/status/1759036864487477735?s=51&t=Z-boW5UHRWKGTmYteOnSkA

Commodities

The Sprott Uranium Trust continues to lose momentum on declining volume.

Sprott Uranium Trust, 2005 to now (volume in bottom panel)

Oil is making a big head and shoulders and nobody is paying attention to it these days. Up through 80 could get spicy pretty fast as CFTC longs capitulated eons ago and there are probably some decent spec shorts out there.

NYMEX Crude Oil, hourly back to August 2023

Copper shorts are also getting squeezed while cocoa shorts are bitter as the semi-sweet pullback from 5800 to 5400 didn’t last and now cocoa futures are riding a sugar high like Willy Wonka as they serve up gains that spec longs are finding to be nothing short of delicious.

Cocoa futures, hourly back to mid-November 2023

OK! That was 6.67 minutes. Please share this Substack with any aspiring finance professionals that you know! Thanks!

Get rich or have fun trying.

Links of the week

Useful information for parents

Here’s a joint piece I published with 13D Strategy and Ben Hunt (Epsilon Theory).

Our children’s lives are mind-warped by smartphones, not in some spiritual ghost-in-the-machine sort of way but in an actual neural-wiring sort of way. This note by Kiril Sokoloff and the 13D team shows how. No paywall on this one. Spread the word.

https://www.spectramarkets.com/amfx/rabbit-hole-11/

Interesting / smart

Do you ever feel like product review websites seem fake, are extremely cut and paste, and obviously lack credibility? Even the ones hosted by brands you thought you could trust like Popular Science? That’s because many of those brands have been bought by private equity and turned into super lame content and clickbait farms.

Full explanation here:

https://housefresh.com/david-vs-digital-goliaths/

I acknowledge that the authors of the piece are biased, but a quick fact check tells me they’re right.

More anti-big-business propaganda from Brent Donnelly

Just for the record: I am pro-free markets. Pro capitalism. Pro small business. And skeptical of very large businesses and monopolies.

Anyway, read this, if you like!

This is from 2017. Prescient.

Music

In case you missed it. Look at Post Malone’s face throughout. He’s in disbelief a few times. “I’m on fking stage with Eddie Vedder!” his smile and eyes seem to say. The best part: around 4:15, Eddie sneaks in a few lyrics from “Better Now” by Post Malone. The best.

I read a lot of macro content, and can confidently say your work is one of the absolute best! Thank you Brent.

Excellent Brent...