Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

First of all, I am more excited than usual about this week’s links (at the end). I hope you enjoy them.

The songs referenced last week in the pictorial rebus puzzle at the end were:

Wow. by Post Malone

Fake Plastic Trees by Radiohead

Boys of Summer by Don Henley, and

Bullet with Butterfly Wings by Smashing Pumpkins

Global Macro

The global disinflation trade continues as markets have decided that the Great Inflation of 2021/2022 is now over and even if rates are 5%, it hasn’t hurt yet so —Whatever! Let’s go. Non-crypto assets are flying again as global macro volatility remains low and the stock of any company that has considered putting the letters “A” or “I” in a slide deck is running madly through Pamplona.

This week was reminiscent of 2018, when a stock would rally 77% because they unveiled their blockchain strategy, or 1999, when a stock would rally 84% because they unveiled their World Wide Web strategy. The only difference here is that it’s not joke tag-alongs like Long Island Iced Tea or Kodak or Corel rallying, it’s the largest companies in the world, and they’re adding literally grillions of dollars of market cap as they unveil their AI strategy.

Apple and Microsoft temporarily added incomprehensible amounts of market cap this week as they announced that they too, would be doing what everyone else is doing. Chasing the AI craze.

Here is the daily change in Microsoft’s market capitalization back to 1995, with Wednesday the fifth largest increase ever. The huge spikes in Apple and MSFT have now just about completely reversed.

MSFT, daily change in market capitalization, 1994 to Wednesday

There are a few reasonable reactions to this chart:

This looks like the volatility profile of a bubble or crash. Volatility clusters around extreme events and perhaps we are in some kind of post-COVID AI echo bubble. It’s possible, for sure. While I do feel the current AI frenzy has many hallmarks of a bubble, timing the pop requires incredible skill, determination, and a bit of luck. If you read this 1998 article about the internet bubble, you could replace “internet” with “AI” and the article would fit right now. It took another two full years before the bubble popped even though many called it a bubble in 1998.

Money ain’t what it used to be. MSFT stock is denominated in USD. If people prefer financial assets over USD because so many more USD have been pumped into the system post-COVID, perhaps this is a denominator effect. That is, fiat currencies are worth less than they used to be because there is so much more fiat in the world. That is, yes MSFT (the numerator) is rallying, but the denominator (USD and fiat currencies generally) is also shrinking.

Dude, use % changes, not market cap changes. Yes! I get why you would say that! But here, I am trying to show not just the increases or decrease in the stock’s value, but the amount of actual dollars being created or destroyed. It’s a different thing.

Anyway, megacap and broader indices are still perky on the back of AI and stability in global yields brought on by disinflationary data. This, despite a 2% wobble on Thursday.

UK inflation

We got good news on US inflation last week and Wednesday morning UK inflation came out. Also very good news, relative to expectations.

Histogram of UK MoM CPI estimates, actual release marked as a blue diamond (from Bloomberg)

Those cyan bars are the histogram of estimates from economists. 20 estimates, all from 0.2 to 0.8… Actual release: 0.1. Zero correct estimates.

Economists are often right, but in aggregate their ranges of estimates are badly miscalibrated and way too clustered due to risk aversion and anchoring. They anchor on the prior data, and they herd toward the median in an effort to find the path of least regret or embarrassment.

Why is the US economy so strong???

We were supposed to be deep in recession by now and the Fed was going to be cutting rates next week. Now, they’re hiking. What gives?

While ex-post explanations are not as satisfying as forecasts that tell an accurate story before the market moves, I think this article from Kevin Muir is worth a read. It’s further down so you have to go here and scroll down to “INTEREST RATE HIKES CAN BE STIMULATIVE?” It’s a lot more nuanced than the title suggests and this isn’t some Erdogan-style screed.

He does a good job of explaining why rate hikes have not had as much punch in 2022/2023 as they might have in other cycles. Long story short: A huge cohort of American consumers and businesses rolled their duration at very low rates in 2020 and 2021. As such, the cost of servicing debts has not responded much to Fed rate hikes so far. The burden of higher interest rates has fallen on the sovereigns and the deficits created by those extra interest payments are at least temporarily stimulative.

This thread from Bob Elliott follows a similar logic and if you read them both I think you get a nice view of what’s going on in the US economy.

Stocks

Incredibly, CFTC positioning still shows a decent short position in stocks.

S&P Futures CFTC Positioning, 2018 to now

This makes it a bit less unnerving to trade S&Ps from the short side as positioning is no longer in the 95th percentile like it was there for a while. Here is how the 95th percentile SPX shorts have done, excerpted from am/FX on April 10, 2023. Not well.

Excerpt from April 10, 2023 am/FX

With the mega shorts partially covered, and S&P now 400 handles higher, at least one reason not to be short is gone. This is not a reason to be short here, but it’s one less reason not to be short. There are better and more sophisticated measures of SPX positioning but most measures, when in the 95th percentile or higher, tend to mean something most of the time. As is almost always the case with any study, 2007/2008 is a once-in-a-lifetime event that is not a useful analog so far this cycle.

Here is this week’s 14-word stock market summary:

Efficiency gains!

Karma Police

In a bull market, everyone is a genius… Except those that recently bet against Jim Cramer LOLZZZ.

Hubris cuts both ways.

The anti-Jim Cramer ETF… BLAM!

Bonds

Bonds have been in the capital markets driver’s seat for the past two years but they have climbed into the back now and other stuff is driving. See here how USDJPY dropped first, and yields followed off the highs.

USDJPY in black, US 10-year yields in blue

Correlation trading is hard! As bond market volatility falls, and the cone of uncertainty around the Fed narrows… Bond movements just aren’t that scary anymore. Throughout this cycle, it’s been higher yields + higher volatility in rates markets that have driven stocks down and the USD up. When yields are flopping around in familiar ranges and vol is low, nobody cares about bonds and USDJPY is the favored plaything.

Fiat Currencies

Speaking of USDJPY. The word segue really makes me mad. Like, segway would have worked perfectly fine. No reason it should be spelled “segue.” Totally ridiculous. That reminds me of a joke.

“Why does the English language have a silent G?”

“To mess up foreigners.”

Here’s Demetri Martin with his spin on that joke.

Speaking of USDJPY though. It has stabilized after a big crap out last week. Note that “crap out” is a reference to a losing roll in the game of craps, so you should grow up a little bit if you thought something else.

But speaking of USDJPY. The big positioning wash out is done and Ueda (head of the Bank of Japan) made some comments that sounded like he doesn’t want to change interest rate policy. If the BOJ changes policy, that would help the yen, so given his comments, the JPY weakened and that means USDJPY went up.

GBP got rekt on the weak inflation print. People like to argue that low inflation is good for a currency or high inflation is bad for a currency but as a rule, that is not true in G10, only in emerging markets. You need a really, really bad stagflation situation in G10 before a currency will sell off on high inflation (or rally on low inflation). As UK inflation went up, the pound rallied. Now, inflation is coming off, and the pound is selling off. Orthodox.

Crypto

Bitcoin and ETH volumes have based, though they remain low. Still, there is a ton of stuff going on in the altcoins and crypto-related equities. Ripple is holding onto gains, the GBTC premium is coming in fast on ETF hopes, and the mining and proxy stocks are wild and crazy.

This next chart shows the volatility of bitcoin in blue and stodgy old blue chip Microsoft in gray. Because gray is stodgy and boring. Bitcoin is barely more volatile than MSFT these days. You call this a casino???

The fun and games are in MSTR and MARA as bitcoin languishes near the top of the 2023 range. The vol of MSTR remains much higher than I would have thought it would be with BTC vol realizing below 50%. Weird.

90-day rolling realized volatility of four things

The will they / won’t they on the BTC ETF is about as tired as Tether FUD but neither of those stories will ever die. Ever.

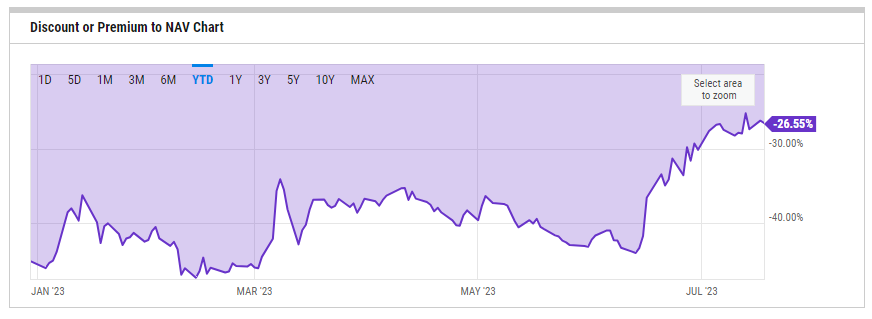

Here is the GBTC discount to NAV

I always caution new traders and analysts to be highly-cognizant of the x-axis on YTD charts like this and investigate what happened further back. Also remember that many charts x-axes are cherry-picked to perfectly make the point or drive home the relationship or hypothesis the chart purveyor wants to emphasize. So when you see a really convincing chart on Bloomberg or wherever, recreate it with a longer x-axis and you’ll start to see what I mean.

Here’s the chart with more x-axis. I’m not making any particular point about the GBTC discount to NAV here; I’m just showing you how the first chart looks like great news for GBTC holders and the second one shows that unless you bought the last eight months, you’re probably not very happy still.

Commodities

Commodities as an asset class or as a financial instrument are highly cyclical. They can totally dominate the mind of the market for a while, as they did after the Russian invasion of Ukraine. Or they can zigzag like an EKG for months on end. Here are Gasoline, Crude Oil, Wheat, and gold prices this year.

The money was made long commodities as an inflation beneficiary before the war and by the time the mania for oil and commodities accelerated after the war began, there was nobody left to buy. Everyone stuffed their pockets with oil at $100 because it was going to $200 and now it’s $75. Middle of a $64/$84 range and boring like these products.

Alright. That was 6.47 minutes. You’re done. Please click like, if you like.

Get rich or have fun trying.

Links of the week

Optimism + action = winning

Related quote: “There's no difference between a pessimist who says, 'It's all over, don't bother trying to do anything, forget about voting, it won't make a difference,' and an optimist who says, 'Relax, everything is going to turn out fine.' Either way the results are the same. Nothing gets done.”

― Yvon Chouinard, Let My People Go Surfing: The Education of a Reluctant Businessman

If you don’t recognize this shape right away, you are probably less than 28 years old

https://twitter.com/trevorbmbagency/status/1676239475532533761?s=20

ROFL

https://twitter.com/Hys3x/status/1527866563365314561

Summer beach reading

If you enjoy dark fiction, this novel will bring out your inner permabear.

Reader discretion is advised.

Music

This song will give you goosebumps, and it if doesn’t, you might want to have your arrector pili checked.

A beautiful song, made extra famous by its appearance in the climactic scene of the final episode of The OC. Listen to the breath she takes in at the very start—before the song starts.

Incredible. A song that completely defies categorization.

“Crop circles in the carpet” refers to the circles left by furniture after it has been removed from a room. The song is about a relationship’s end, possibly her parents’ divorce.

Blockbuster. ;-)

The Microsoft graph was absolutely brilliant! Thank you!