Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Global Macro

The Fed threaded the needle this week with a non-commital meeting that opens the door for further hikes if the US data remains strong. Spoiler alert: The US data remains strong. Fiscal spending on infrastructure, a strong housing market, record rents, stabilizing manufacturing, minimal transmission from Fed rate hikes, and a resurgence of inflationary pressures all point to more tightening ahead. This, despite Fed Funds already in restrictive territory and real rates back near their long-term average.

We remain in “I Can’t Believe It’s Not a Recession!” economy where prior assumptions about economic weakness on the horizon have been impossible to shake even as the evidence of US economic strength stacks up higher than the Burj Khalifa.

Stocks

Strong economy, stable yields, goldilocks disinflation… What’s not to like? Stocks love it, obviously, and have continued their straight-line trajectory up, up and away. It feels insane to say anything bearish right now, but here goes.

I don’t generally publish a ton of bearnip like the next chart because I think one of the greatest leaks in finance is staying bearish too much of the time and because there is always going to be plenty of bear porn out there; if you want bearish charts, just go to Twitter and scroll for a few minutes. I’m making an exception in this case because I didn’t know what was going to pop out here, I just plugged the condition into my Excel sheet, and this is what I got:

DJIA marked with 11-plus day winning streaks

This stuff is not actionable on its own. Imagine going short in early January 1987, knowing a crash was coming. You would have been stopped out, almost surely. This does give another example, though, of how we are in most unusual and potentially sketchy times for stonks. The VIX is signaling all clear while the outperformance of mega vs. equal-weighted QQQ (see yesterday’s piece), the explosion in volatility in MSFT, and the record streak in the DJIA all point to meaningful tail risk despite the ongoing bull market. Not to mention the resurgence of inflationary pressures.

Seasonality

How weak are equities in August? The average August return is -0.4% but the median is +0.2%. In the context of a raging bull market since 1992, that is quite weak. September is weaker, FYI.

Here is a chart of August performance. You can see that the average is skewed by a huge 15% drop in August 1998, and we’ve been flat in August since then. Flat in August is incredibly weak for an asset that went from 415 in 1992 to 4627 today!

Cumulative performance of long SPX in August 1992 to now

Very, very rarely, there are moments when it feels completely stupid to have a particular view. I remember feeling that way only a few times, most recently in December 2022, when I was bullish stocks:

https://www.spectramarkets.com/amfx/am-fx-optimism-feels-crazy/

Bearish stocks feels stupid right now. The rally has been so relentless and so much cash has been burned on bearish views that it feels silly to be bearish here. But with the AI echo bubble, strange behavior under the hood, megacap record outperformance (see yesterday’s am/FX if you’re a subscriber), MSFT wildly volatile, Dow up 13 days in a row, bearish seasonality in August and September, and inflationary pressure increasing again… Maybe this isn’t the worst time to take a bearish shot. It is also notable that MSFT has tanked a bit post-earnings, suggesting perhaps we finally reached a point where the AI bubblette is priced for perfection.

As a 6-month play, I like the short QQQ vs. long QQQE or Sell December 2023 MSFT 350/370 call spread and buy a December 2023 305 MSFT put. This is not investment advice.

Textbook Dikembe Mutombo formation in MSFT stock

To be clear, I know it feels ridiculous to be bearish stocks, but I’m bearish stocks.

Here is this week’s 14-word stock market summary:

America, fk yeah. But under the hood thar be weirdness in them there stonks.

Bonds

Inflationary pressures are back. Oil is rallying organically on no recent incremental news. Gasoline prices are making new highs for 2023. Markets are forward-looking and the disinflation narrative might have reached an apex on the most recent US CPI release.

US 10-year yields remain calm in a range, but if they take out 4.09%, there’s going to be absolute bedlam. US Initial Claims and GDP were strong this week and imagine what things are going to look like when manufacturing snaps back.

US 10-year yield with bedlam-free and bedlam zones indicated

Fiat Currencies

The People’s Bank of China (PBoC) was messing around in FX in the first half of July as they managed their currency and a basket of G10 currencies, selling dollars with no regard for external variables. You can see it in this chart, as EURUSD dislocated from the Germany vs. USA rate differential. Normally, but not always, currencies follow rate differentials.

The suspected interference ended this week and a dovish ECB took EURUSD back down after a spicy post-Fed rally.

August tends to be a great month for the USD and a bad month for NZD and GBP particularly. While the old orthodoxy was: strong commodities / weak dollar, that has not worked for ages because the US is a net exporter of crude now and when inflation rises via the commodity channel, the Fed pricing gets more hawkish faster than the pricing of other central banks. In other words, US yields are high beta and rising commodities pushes yields up, and US yields up the most. That’s generally good for the dollar.

The US is in a tight monetary + loose fiscal regime and that tends to be good for a currency. So despite some technical dollar weakness driven by non-price-sensitive selling, the USD looks set to have a good month of August.

Crypto

I used to write a weekly about crypto and I am glad I don’t have to do that in recent months. There’s a lot of regulatory and idiosyncratic stuff going on, but price movement in BTC and ETH has been worse than moribund. Transaction volumes are low, and interest has waned significantly despite what seems like rising odds of a spot bitcoin ETF approval.

It is going to be a tough summer for all that newly-built crypto trading infrastructure. Halving and a spot bitcoin ETF approval are way out on the horizon but short-term: yawn.

Commodities

Most of the commodities rallies we have seen over the past two years have had an element of financial speculation to them. Commodities as an asset class has brought billions of speculative dollars into the commodity markets and can often lead to huge swings and overshoots as the commodity markets cannot always handle the size of the flows specs want to move.

Given the important role of hot, speculative money in commodities, you want to stay away from popular trades in commodities because the herd moves fast and breaks things, and when the narrative turns, it can look like a bunch of buffalo stampeding toward a door like this:

That’s how you get front-month crude trading at -$40 like it did in 2020 or at $150 like it did in 2008. Trapped specs will transact at literally any price when their risk managers tap them on the shoulder.

In contrast, this week there were no headlines. I didn’t see any superspike calls for $200 oil or any thought pieces on why crude oil is the only store of value in a world of fiscal largesse. OPEC was silent. And then crude went higher, then higher again and it’s now trading near the top of what has been a well-defined $64/$84 range. RBOB, a product used to make gasoline, was even more impressive. Here are the charts:

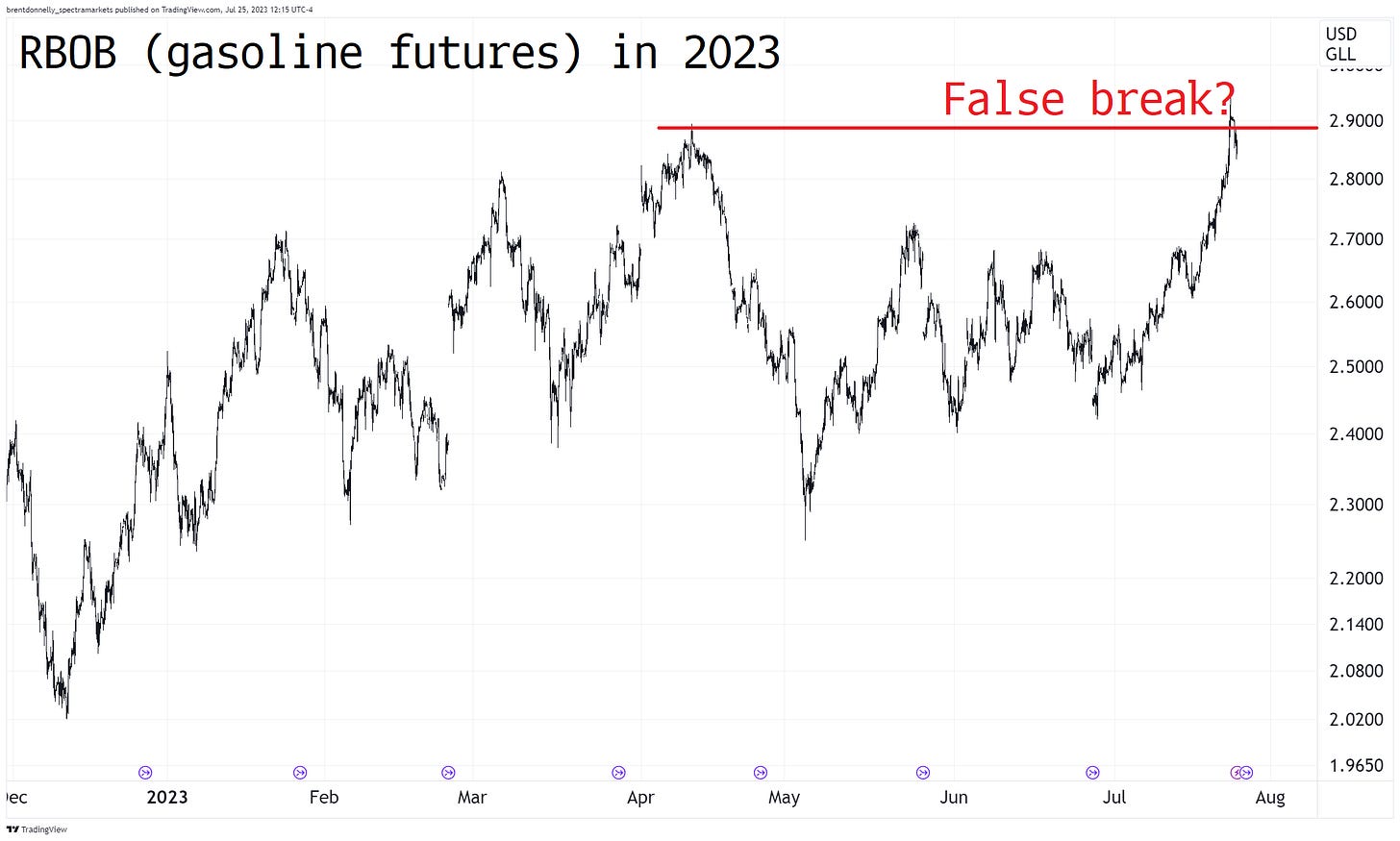

And here’s RBOB. The rally is more impressive, but the chart is a tiny bit worrisome as we had what looked like a nice clean break of the 2023 highs, followed by a failure.

If you’re the curious type, you might be wondering what exactly is RBOB?

Reformulated Blendstock for Oxygenate Blending (RBOB) gasoline is a fuel product made from refined crude oil. RBOB gasoline often goes by the names gasoline, petro gasoline or petrol. Edwin Drake, the first American to drill for oil, discovered gasoline by accident when he was distilling oil to make kerosene for heating. Drake considered gasoline a useless byproduct of the distillation process and discarded it.

Read more at: https://commodity.com/energy/rbob-gasoline/

Next time you’re getting drunk with a bunch of commodity traders, ask them what RBOB stands for. They probably won’t know and then you can make them feel stupid.

Organic, non-speculative rallies like the one we are seeing in energy right now are more likely to be persistent than rallies fed by specs. If this rally continues, which I expect it will, it will have inflationary implications and will eventually have a negative impact on discretionary consumer spending. The real variable that matters is the retail gasoline price, and that lags RBOB by a bit. Funny how retail gas prices lag when RBOB falls, but they move almost in real-time when RBOB rises. It’s almost as if retail gasoline stations are profit-maximizing entities that prefer wider margins!

RBOB vs. Average US Retail Unleaded Gasoline Price

Anyway, this oil rally feels different to me. Keep an eye on energy prices. The Great Inflationary Dragon has been stabbed but not yet slain.

Alright. That was 6 minutes. You’re done.

Get rich or have fun trying.

Links of the week

Interesting / smart

https://medium.com/@moontower/berksons-paradox-99a5cbdb891e

Funny / useful / true

Music in memory of Sinead O’Connor

Sinead’s music was a slow-dancing highlight of a few of my high school dances. I wonder where Jessica Hamilton is now. Chris Cornell’s covers are always incredible.

Concise. Touch of whimsy. Packs a lot of informed and informative punch. Much appreciated 🙏🏼

I love reading your stuff!