Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

I know today’s Thursday, but I’m off on a family junket tomorrow so here you go!

Global Macro

First of all, sorry I sent you am/FX by accident on Monday. Misclicked a mailing list and BLAMMO. Hope that did not bother you as my intention is not to spam anyone.

This week was another equity gorge-fest as everyone stepped up to the feeding trough to gobble up mass quantities of stocks. Notable, though, was that this wasn’t your typical 2021 global macro ripper as crypto went down, oil is sucking wind, and VIX is at the lows as YOLO call buyers have lost a bit of their mojo.

In other words, there’s some nuance as the market rips the offer in every stock and stock market index but hesitates to become twice-bitten in crude and crypto.

Big week in central banking as the Fed delivered its hawkish skip, ECB was outright hawkish, and the BOJ result will come out in a few hours. And the PBoC reignited some China optimism with a series of rate cuts, and rumors of a 140B stimulus package.

The other theme percolating in the background is a strong appetite to sell volatility and own carry trades. It’s reminiscent of 2006 and 2007, when you had the entire market positioned for a recessionary calamity and instead, you got two years of grinding, low-vol, carry-friendly action.

Economics-wise, all eyes are on Initial Jobless Claims these days as they have ticked meaningfully higher. There are some weird things going on with seasonality and fraudulent claims though, so it’s hard to say if this is a blip or a turn.

If this is a meaningful turn, it has major implications for US yields (lower) and the USD (lower). Initial Claims is one of the timeliest, most accurate, and least noisy economic data points and it should be watched closely. Every Thursday at 8:30 a.m. you should be on high alert for incremental information.

And unfortunately, another Fed transgression that will probably go unpunished:

Stocks

There appears to be a global shortage of stocks! Everyone suddenly wants them and with most indexes pumping out 1% daily returns, those 5% per year T-bills suddenly look boring and staid.

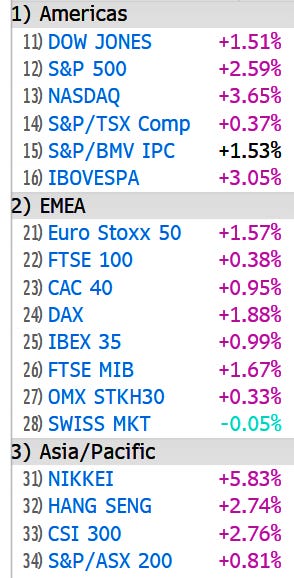

Here are some major indexes this week:

SPX (black bars), NASDAQ (blue), FTSE (yellow), Nikkei (red) and Toronto (purple)

Big moves with Nikkei leading the pack up more than 5% in the past five days!

Global equity indexes, 5-day change

Here is this week’s 14-word stock market summary:

5% annual yields look paltry vs. 3% in a week. Buy Mortimer!

Bonds

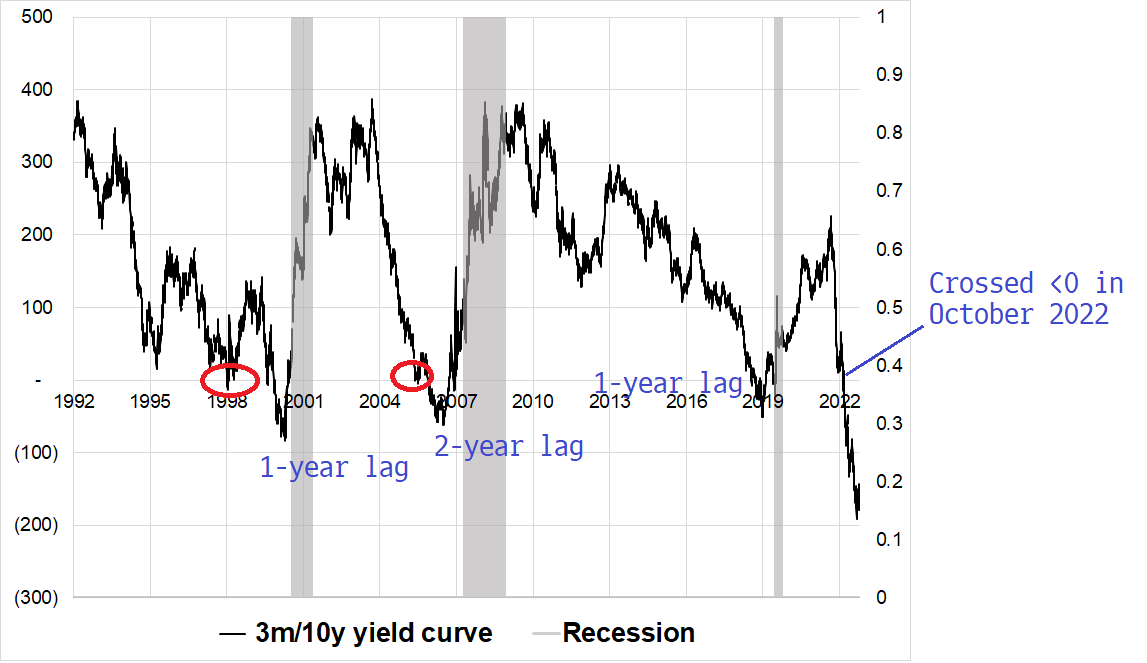

The best recession predictor out there is the 3-month/10-year yield spread in the USA and it’s been screaming recession for eight months. The key with predictions and forecasts, though, is that they need a time condition. Like if the Fed says: “We’re going to get inflation down to 2%, we promise!” but does not give a time condition… The forecast is bullshit.

Good predictions have a direction, a magnitude, and a timeframe attached. For more on this, I highly recommend the book Superforecasting. It’s one of the best books for thinking about thinking and coming to grips with just how insanely difficult it is to predict the future.

Anyway, the good thing about the yield curve is that it’s a flawless recession predictor. The bad thing is that it doesn’t tell you when, so the prediction can do you more harm than good. This was the case, again, in 2006/2007 when the recession alarm honked briefly in February 2006, then more loud and persistent honking from July 2006 all the way to the global financial crisis. That 2-year lag destroyed a lot of bear capital.

US 3-month minus 10-year yield, 1991 to now

There are more nuanced ways to analyze this, for example, many believe it’s the resteepening that signals danger, not the inversion. But there you have the issue of how to define adequate steepening for your signal etc. Basically, the inverted yield curve is a boogeyman that is real but waits for you to fall asleep before it pounces. For now, the inverted yield curve is harmlessly lurking in the woods like those weird scary clowns in 2016.

Security cam snapshot of the inverted yield curve

Fiat Currencies

The Fed is getting outhawked! Canada, Australia, and Europe are showing hawkish feathers and China is looking less bad, and generally what you want if you’re short USD is: China good, Fed on hold, and other global CBs hiking. Check, Check, Check.

The trend has been your enemy this year, so the market is treading cautiously here, but AUD isn’t waiting around as it’s poking through the ceiling to make a new 3-month high.

The frantic narrative-hopping that has defined 2023 is right there on the AUD chart. AUD tends to trade as a proxy for China, but with the Reserve Bank of Australia (RBA) one of the loosest CB’s in the world until recently, AUD traded with a downward bias after the China reopening fever cooled.

Now, the RBA is playing catch up with hikes and AUD is happy about it.

AUDUSD hourly, late 2022 to now

Crypto

Tons of sturm and drang in crypto these days as the SEC crackdown has Americans and CZ looking nervously at their phones, waiting for more bad news. I continue to believe that shuttering or prosecuting exchanges doesn’t matter much for the medium-term price of bitcoin, but with all those other coins getting slammed as it’s increasingly obvious they will be regulated as securities, bitcoin is the baby and the sh-tcoins are the bathwater in the short-term.

Here’s the evolution of the top 15 cryptocurrencies over time, for your viewing pleasure. The chart reads right to left, 2013 to now.

And for context, here are the relative market caps right now. BTC, ETH, and USDT dwarf everything else.

Crypto is trading idiosyncratic, not macro these days as you can see here:

One of the biggest and most obvious risks to any cryptocurrency other than BTC was that they get labeled as securities in the USA and delisted. This is not hindsight, I have been writing about it (as have others) for almost two years.

Perversely, one could now make the argument that the risk has finally been recognized and if you are in love with something like MATIC, it’s 40% cheaper and now properly priced. In other words, your margin of safety is now larger in mainstream altcoins because the regulatory risk is appropriately priced in.

But if you live in the USA or another crypto-antagonistic jurisdiction, be careful where you store them.

Commodities

Normally in a USD down, China happy, stocks up environment, commodities would trade well. This is not happening at the moment with oil continuing to look horrendous and raw industrial commodities (stuff like copper scrap, lead scrap, steel scrap, tin, zinc, burlap, cotton, print cloth, wool tops, hides, rosin, rubber, and tallow) trade poorly.

Here’s the raw industrial commodity index from 2021 to now. It looks a lot like a chart of Solana or expensive watches, or Wayne Gretzky rookie cards, or any of the grillion other assets that exploded in value during the 2021 Everything Bubble and then reverted to the mean in 2022/2023.

This underperformance by non-financial commodities would normally be another sign that the global economy is not particularly healthy, but as last week’s Friday Speedrun title indicated: all news is good news right now, so who cares about the future?

I’m being flippant, but it’s important not to obsess over indicators that confirm your bias if the market is trading something completely different. For now, there are plenty of signs of global economic weakness out there but these things only matter when they matter.

That’s one of the incredible frustrations of economics and markets and trading: It doesn’t always fit a neat, logical explanation. Sometimes people just got way too beared up, way too early, and not enough calamities hit and so they have to cover and the rising price creates feedback loops where more shorts have to cover and trend-followers start to get long and buying begets more buying. That’s why traders use stop losses. You’re gonna be wrong a lot. And this year, the entire market has been wrong a lot.

As my first boss often told us: “If it was easy, it wouldn’t pay so well.”

Alright. That was 5 minutes. You’re done.

Get rich or have fun trying.

Links of the week

Sad passing

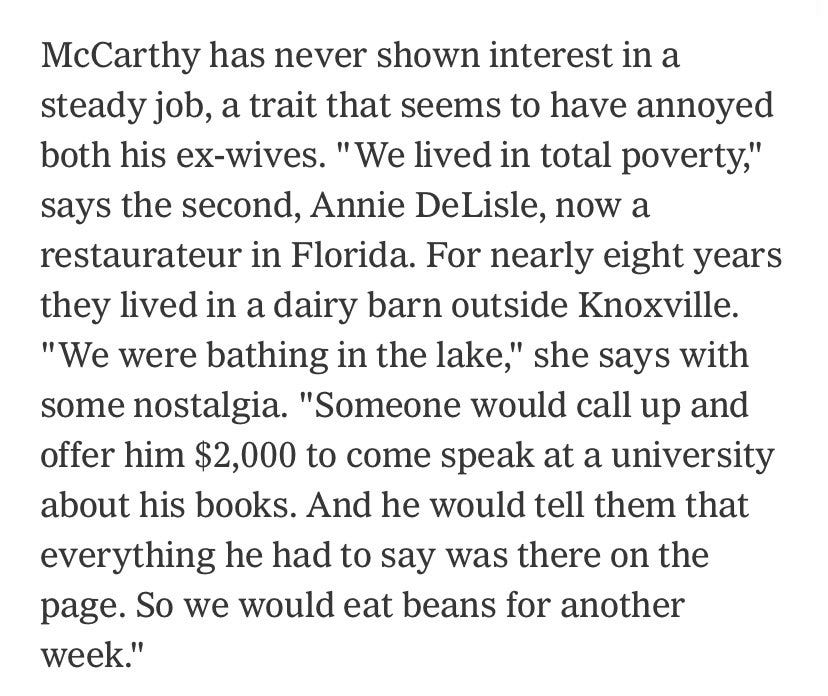

Cormac McCarthy died this week. That makes me sad. He is one of my favorite writers. He gave the world so much perfectly dark and beautiful prose. And he was kind of an intellectual badass. I hope he is resting peacefully.

https://twitter.com/danozzi/status/1668709496762556416?s=20

On the fragility of life

Nick Cave believes that we are deeply flawed, impermanent creatures who can sometimes do extraordinary things.

https://www.newyorker.com/culture/the-new-yorker-interview/nick-cave-on-the-fragility-of-life

While on the topic of death

This song was playing in the car when one of my best friends told me about the death of his Dad, who had just passed away at the age of 40. That conversation took place in 1997, yet in my mind’s eye, I can still see every detail inside and outside the car. Songs can be incredibly salient, powerful bookmarks.

Regardless, it’s a beautiful song and I hope you like it.

The extra stuff this week was a downer, I know. I will smile again tomorrow. And maybe the finite fragility of life on Earth is what makes it so awesome.

Do you really want to live forever?

thx for book reco

Thank you for your extra words. It’s a great reminder that we are but dust.