Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Before we get started, here’s today’s am/FX for your weekend reading pleasure. It’s a longer-than-usual piece about my trip to Epsilon Connect in Nashville. 12-minute read.

Global Macro

The first half is over! Good luck in H2.

The good vibes are back this week as the US data is good, but not too good, and the Great, Inevitable Recession of 2023 has been pushed back another few months. The path of least resistance is the soft landing that nobody is positioned for, though at this point most of the equity bears have covered and there is a grudging complacency as markets remain mostly rangebound.

Everyone had expected bad news on global housing this year, but as you can see in today’s first chart, forward-looking stuff like NAHB homebuilder sentiment and XHB (the homebuilding ETF) are showing much optimism. There are not enough houses out there so anything you can build you can sell.

Reshoring and US fiscal and infrastructure spending are supporting the economy too. See this story, for example.

US Consumer sentiment, like homebuilder sentiment is strengthening as inflation angst subsides, gas prices are lower, and jobs are still plentiful. Help wanted signs everywhere! Next week’s jobs report will be of major interest.

Stocks

The S&P gapped up through 4300 on June 12 and has held that gap nicely as you can see in the next chart. It’s very difficult to be bearish stocks given this price action.

S&P 500 daily, March 2022 to now

Also note that CFTC positioning still shows a huge short position as you can see here:

CFTC S&P positioning, 2010 to now

The gains in the broader market come despite a drop in NVDA this week as it continues to stall in the 400/435 zone. MSFT was also lower on the week so the worries about narrow breadth are a bit less intense right now. A lot of stocks and sectors are rallying, not just tech.

Here is this week’s 14-word stock market summary:

Stocks up huge in H1, exactly the opposite of what everyone thought would happen.

Bonds

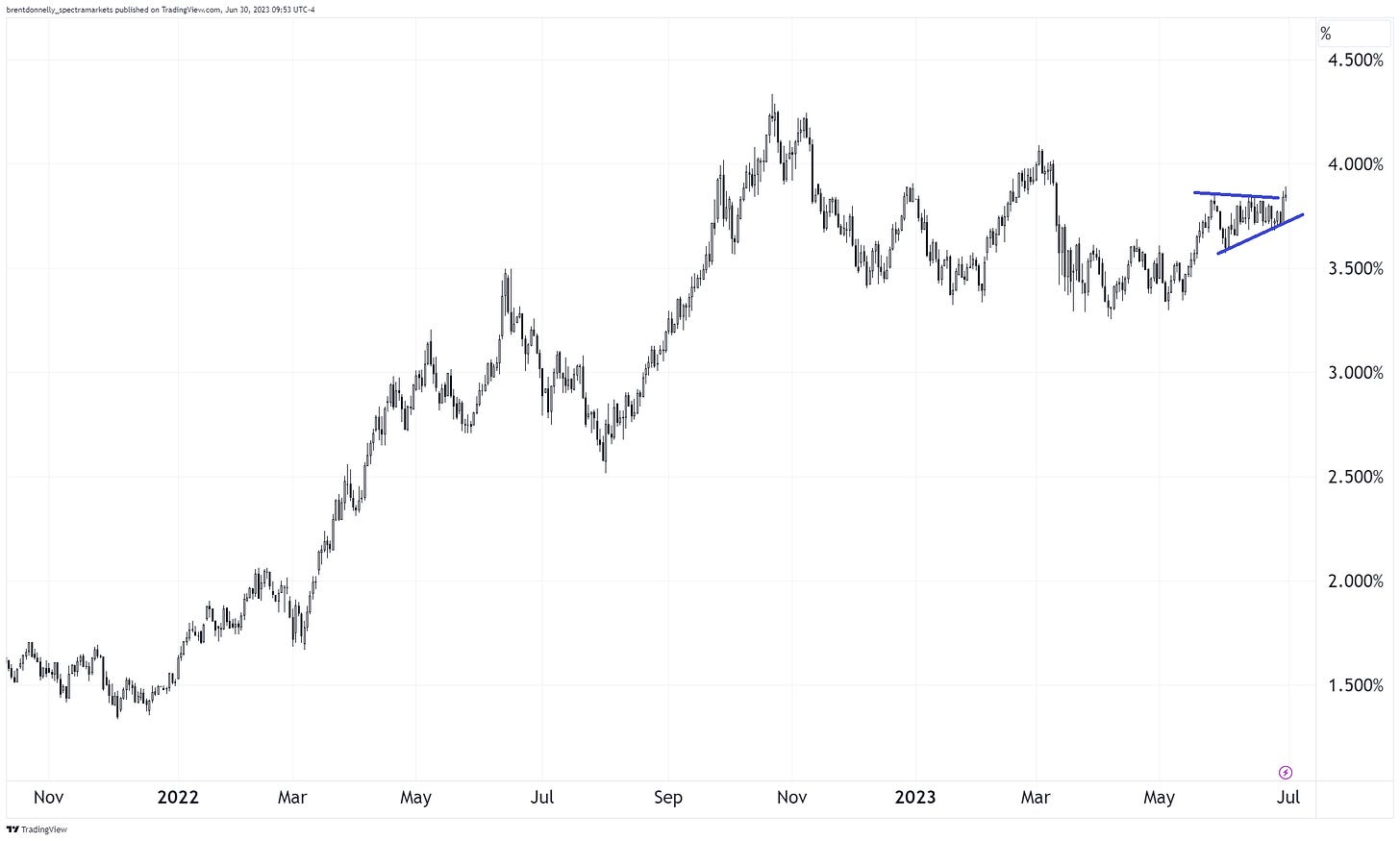

Optimism is creeping in with regard to US growth and US 10-year yields are challenging, but not yet breaking the top of the range. This hasn’t scared other markets like the NASDAQ because the news is more about optimism than inflation right now so higher yields could be an OK thing.

The super tight consolidation / triangle that has been building over the last month or so looks like this:

US 10-year yields, late 2021 to now

People are still in a state of mild disbelief as everything looked so, so bad in March and none of the bad stuff that seemed inevitable has eventuated. Yet. As long as the yield curve is sending scary signals, we will be on permanent recession watch but as discussed in prior weeks… If we don’t have any idea on the timing, the prediction isn’t particularly useful.

Fiat Currencies

As suggested by that Bloomberg article I linked up at the start, the US looks like the fastest horse in the race right now with Europe still kinda soggy and China mired in a balance sheet recession and facing a demographic cliff, too.

Peter Zeihan: China’s demographic collapse is here.

That has helped the USD, though volatility remains low and excitement levels are roughly Fyre Festival 2 levels. EURUSD has been 1.05/1.11 all year. That is a tiny range relative to history.

USDJPY has recaptured much of what it lost after the MOF intervened and BOJ tweaked policy last year and we are grinding back towards 150. Japanese officials are getting annoyed and probably have the intervention machine ready to lob out another 50 billion USD at some point.

Nobody particularly loves the dollar, it’s just going up because of macro conditions, not speculators.

Crypto

The dream of a spot bitcoin ETF continues to swirl as a ton of big names like Blackrock and Fidelity all tossed their hats in the ring at once. The thinking is this would unlock a new wave of demand and it’s super bullish. Then today this:

*SEC SAYS SPOT BITCOIN ETF FILINGS ARE INADEQUATE: WSJ

Bitcoin hourly back to 12JUN

Overall BTC trades OK still, though it’s lagging the NASDAQ dramatically as the flows and volumes in crypto remain moribund. It’s like the market wants to go higher SOOO bad but can’t quite muster the energy to take out this 30k/32k zone.

Commodities

The balance sheet recession in China makes it hard for commodities to rally, and high real rates and rising nominal yields make holding gold very expensive. T-bills are a much better safe haven or place to park your money right now as you get paid 5% to sit around. In contrast, in gold you have downside risk to 1700 and no yield.

This article on gold by Tyler Cowen is interesting. He is always a solid follow.

Alright. That was less than 5 minutes! Sorry I’m a bit less funny than usual today, I feel. I’ll be funnier next week. You’re done.

Get rich or have fun trying.

Links of the week

Interesting / smart

https://mimetictheory.com/articles/casting-the-first-stone-by-rene-girard/

Good weekend read

https://www.wired.com/story/christopher-nolan-oppenheimer-ai-apocalypse/?ref=thediff.co

Mind-blowing chart

https://twitter.com/donnelly_brent/status/1673686540877193216?s=20

thanks AK !

Great weekly overview of markets and macro! Also, your AM/FX report today on the Epsilon conference was super interesting! Thanks for the great work!