Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Global Macro

Before we get started, I want to talk about percentages. They can be a sloppy metric when moves in an asset price are large.

When you see a headline like this:

*PACWEST BANCORP SHARES JUMP 30% AT THE OPEN

You might think “Wow, Pacwest is doing well!” Meh. Not really. Here are a few headlines from the past 10 trading days:

*PACWEST BANCORP TRADING PAUSED AFTER SHARES SINK 29%

*PACWEST BANCORP RISES TO A SESSION HIGH, UP AS MUCH AS 18.4%

PacWest Stock Sinks 25% After Disclosing Fresh Deposit Outflow -- WSJ

Here’s a bit of visual context.

PACW common stock, daily 2021 to now

If a stock drops 20% then rallies 20%… Is it back to flat? No.. It’s down 4%. If it started at 100, it’s now at 96. Here’s a chart:

Something goes down 20% then up 20% over and over

This truth can be painful in trading. If you lose 10% of your capital, you need to make 11.1% to get back to flat. If you drop 50% of your capital, you need to gain 100% to recover. If you lose your mind and drop 90% of your capital, you will need to make 1,000% just to get back to flat! The further you fall from your starting capital, the harder it will be to ever come back.

So when a stock is 80% off the highs, like PACW, it is essentially meaningless when it rallies 10%. It’s often more like the last twitch of a dead bird lying on the gravel after it has collided at full speed with your kitchen window.

The headlines aren’t wrong per se, they are just meaningless. Be sure you read the financial news in context because journalists are incentivized to get clicks and they will generally word a headline in the most exciting and persuasive way possible, even when the reality is boring. Boring headlines don’t get clicks.

This phenomenon of huge rallies in stocks that are nearly dead is also important to remember if you are ever shorting stocks. Low-priced stocks can rally an infinite amount, as we saw with GameStop and other meme stocks in 2021, Porsche in 2008, and countless other examples. Shorting low-priced stocks is risking infinity% to make 100%. No bueno.

I cover this concept a bit more in my latest educational Substack: Week 49 of Fifty Trades in Fifty Weeks. That Substack is focused on trading, not macro. If you want to be a trader, I think you will find it useful. But if you have never heard of it, you might as well wait a few months because we’re making it into a book.

And here’s a video I did on rigorous risk management when selling short.

Three bullets

Here are the global macro bullets this week, in subjective order of importance as judged by me.

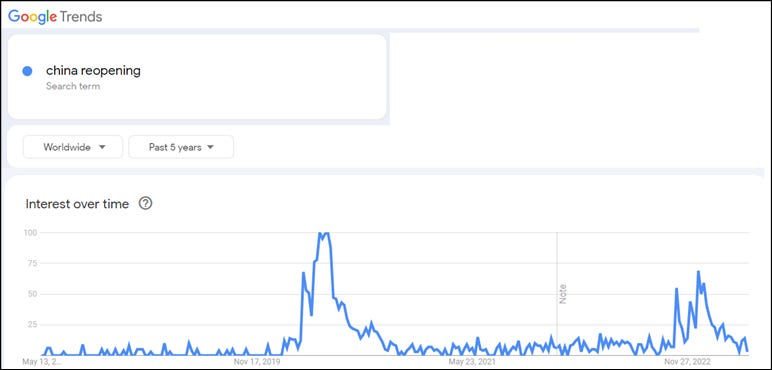

The China reopening narrative is dead and the whole thing was a huge nothingburger.

Bloomberg stories about China reopening, 2016 to now

Google searches for “China reopening” 2018 to now

The market is already looking through Q2 and sees sluggish growth, falling inflation, and structural deceleration as communism takes increasing priority over capitalism under Xi.

German economic data released this week was nicht gut.

MoM change in German Retail Sales, IP, and Factory Orders, 1991 to now

Inflation in the United States continues to grind lower. Ten months in a row now of lower YoY numbers. This is good but not great news as the pace of the drop in CPI is laborious. Goods prices are actually deflating now, but services remain sticky. I am highly but not 100% confident that falling goods prices will pass through to services soon.

AD

am/FX is my daily macro note that goes to a couple of thousand traders and investors. Learn more, faster. Subscribe here.

END OF AD

Stocks

In markets, a “handle” is the front one or two digits of a price. So if the S&P 500 is trading at 4150, it’s on a 41 handle. If USDJPY is 135.68, it’s trading on a 135 handle, etc. Look at this nonsense:

Days where SPX traded on 40 or 41 handle

Stocks are caught in the whirlpool of scary forward-looking data (like credit tightening) and OK real-time data (70-year low in the US unemployment rate). Large short positioning puts a floor under stocks and lousy seasonality is a cap on sentiment.

One of the big lessons of 2007/2008 was that if you identified the dangers and got short stocks early (say Spring 2007)… You got your face ripped off. There have been many dying canaries in the US economic coalmine but so far no calamity has hit. Ideally, we will know it when we see it. Can’t just sit around bleeding theta on shorts. If you are bearish, you need good timing or you need to pick single names like TSLA that can go down even if the indexes rally.

Here is this week’s 14-word summary of this week’s stock market action:

Inflation is coming off but very slowly and those regional banks are still sus.

Interest rates

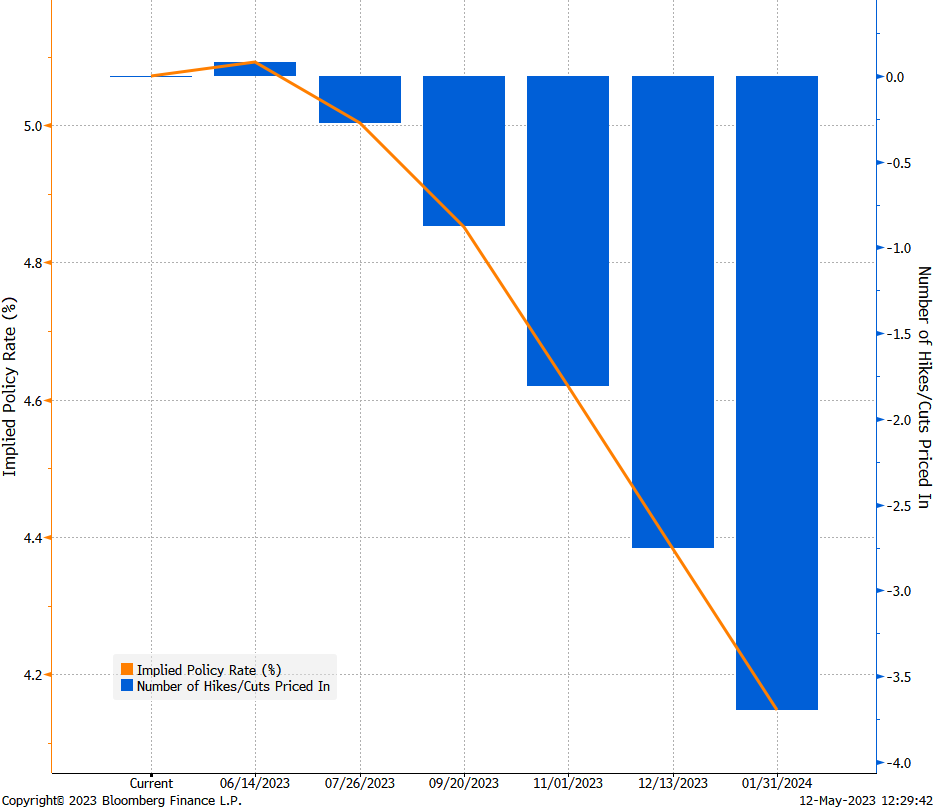

Blame it on the range as US 10s are just vacillating. Meanwhile, the short end is pricing 3.5 cuts from the Fed by January 2024. Aggressive but easily possible. It looks like a lot of cutting but remember that in a crisis, they can cut 75bps in one shot, in between meetings. So the pricing is not crazy.

Fed market implied policy rate now til January 2024

Fiat Currencies

The dollar is on a comeback as brutal data in China and Germany took the wind out of the somewhat popular EURUSD long trade. The market is not ready for a USD rally and the premise for short USD was US economic underperformance vs. the rest of the world. This week, we got the exact opposite.

EURUSD hourly chart with 100-hour and 200-hour MA

There is not much in the way of support until 1.0500/50 so we might see a zippy little move at some point as stale USD shorts get annoyed with themselves and start smashing the SELL button. AUD and NZD dumped as the final China reopening longs hit the “no mas” button.

Crypto

Not a good week for crypto as an asset class. Even many crypto insiders were cringing this week as the PEPE madness unfolded.

Editorial note: I think “cringing” should be spelled “cringeing” because otherwise it looks like it should rhyme with “ringing.” But I don’t make the spelling rules.

Whether you agree or disagree with its message, I think we can all agree that this is one hell of a quote from Representative Brad Sherman:

"Peru is way ahead of us in cocaine production, China's way ahead of us in Oregon harvesting, we don't need to keep up on those things. And we don't need to keep up on crypto," the lawmaker said.

The rally and collapse in PEPE is a win for supporters of the idea that crypto is a complete clownshow casino, though those people fail to distinguish between the OG first mover (bitcoin) and the gambling tokens / unregulated securities.

Meanwhile, the crowd that roars any time BTC rallies and NASDAQ doesn’t is silent this week as the opposite is happening. Big support comes in 20k/22k.

Bitcoin (black) vs. NASDAQ (blue) hourly back to January 2023

Commodities

With the USD on a comeback, the market long gold, hedge fund YTD P&Ls low or negative, crypto soggy, and yields steady… I think a positioning wipeout is coming soon in gold. Not investment advice.

Gold triple top at the all-time highs

OK! That was 5 minutes. You’re done. I hope your weekend is special. So very special.

Get rich or have fun trying.

Links of the week

Interesting / smart

This guy is the best when it comes to the state of the world at the intersection of geopolitics and macroeconomics. Absolute must read imo. Free to sign up.

http://mehlmanconsulting.com/wp-content/uploads/The-Four-Addictions-Q2-2023-Mehlman.pdf

Voice of reason

Straight-up stupidest headline ever

Smart / useful

This is an excellent framework for thinking about how to use AI.

Music

Shaq rap FTW!

That song sample you might hear in there is Drowning Pool’s “Bodies” which was a wicked mosh pit alternative / nu metal hit in the early 2000s. It still kicks ass. Here it is.

looking fwd to your new book release!

You sir, have a great taste for music. Please share some music playlists here or in the future on your blogs...