Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

Follow me on Twitter here. Follow Spectra Markets here.

The About page for Friday Speedrun is here.

And https://twitter.com/ross_justin_d is a contributing editor.

The idea is to keep you up to date on what matters in finance and help you level up your knowledge of global markets. With minimal exertion. For free.

If you’re a student, you’re newish to finance, or you’re just a curious life-long learner person… You are in the right place. The main body of Friday Speedrun should take about five minutes to read if we’re doing this right.

Here’s what you need to know about markets and macro this week

Global Macro

The big story of the week was stability. The big banks reported earnings and look fine. That helped inspire confidence that the mid-March regional bank blowups were idiosyncratic, not systemic.

Economic data points to a slowing US economy, but nothing scary (yet?)… Inflation is sticky but it’s coming lower and lower and the angsty psychology around inflation in the US has calmed down significantly. My friends aren’t bitching about menu prices like they were last year.

China reopening keeps humming in the background and while white-collar peeps are losing jobs in the US, there is still a shortage of people to work in jobs that do not require a college degree.

This chart from Mike Green is clear and informative:

Mike Green is an OG super smart good guy/smart guy whose knowledge is final boss level. Here is the link to his latest (which is where that chart comes from). I don’t always understand everything he says but my philosophy is that if you understand 100% of everything you are reading, you are probably not learning as much as you could be.

Another example of something I enjoyed even though I only understood maybe 50% of it the first time through was David Deutsch’s The Beginning of Infinity. That book is brain-altering.

Anyway, here’s how the “collapse” in US home prices looks, so far. This is why it’s good to look at data, not just narratives and anecdotes and Twitter doom.

US Index of Home Prices, 1987 to now

Stonks

Funds and money managers are extremely bearish (pessimistic) on the US stock market and particularly S&P futures. I don’t like being contrarian just for the sake of being contrarian, but the track record of speculators going max short in S&Ps is not very good. Short positions, put simply, are bets that the security or index or market in question will go down. Shorts are bearish. Longs are bullish.

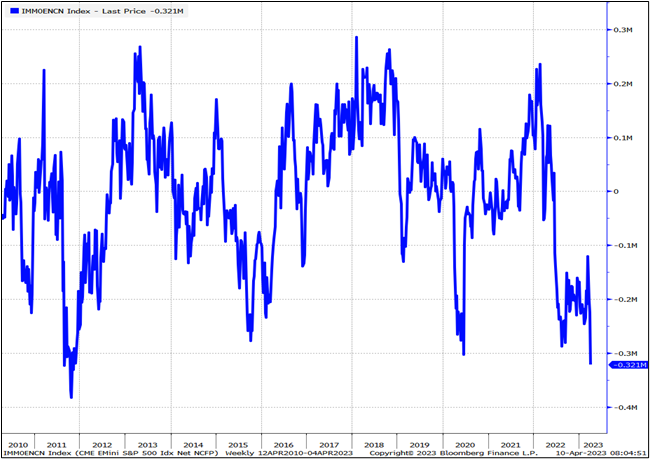

To measure positioning, the CFTC tracks all the futures positions and comes up with a net position. Here it is for S&P futures back to 2010. “Non-commercial” just means speculators (not hedgers).

S&P futures, non-commercial net position

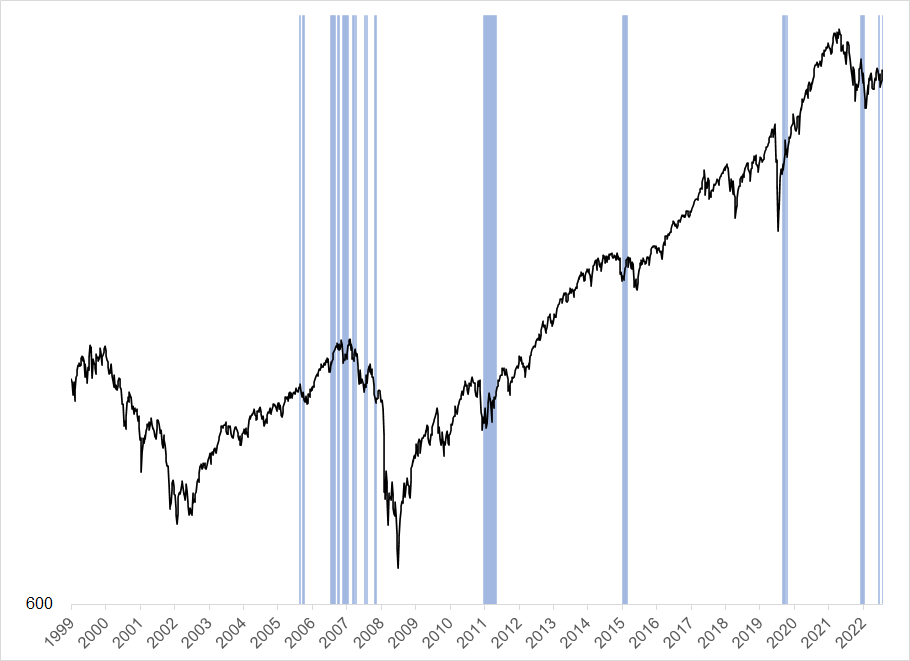

If we isolate all the times the position was in the 95th percentile of most short like it is now, and map those moments against the S&P 500 chart, it looks like this.

S&P 500 and times when positioning was mega short

The shorts won (eventually) in 2007 but the other times were all bad timing for uberbearishness. Does this mean stocks can’t go down? No! Does it mean you are part of the herd if you’re bearish right now? Yes.

This has been one of the most boring and mind-numbing periods for stocks. Ever. Stocks have gone nowhere for nine months.

Stocks: Boring like C-Span

Pro tip: It’s OK to not play the game when it’s boring. Sitting in cash at 5% yields isn’t the worst decision you can make if you’re not sure what to do with your money. Sure, in the long run, stocks go up, but there are also some decades where they go nowhere. Sometimes playing the game not to lose can be more sensible than playing to win. See today’s links at the end for a classic essay on this topic. It’s a super important topic and I strongly encourage you to take 15 minutes this weekend and read the essay.

And here’s the 14-word summary of this week’s stock market action:

The banks are OK. The economy is slowly slowing, slowly. People are super bearish.

Bonds

The US economic data was pleasantly soft this week, like Charmin. Normally that would mean that bond yields would go down because softer inflation readings and lower growth generally lead to lower market interest rates. Here is what actually happened.

US 2-year yield this week (hourly chart)

Whenever a market does something weird or counterintuitive, you should sit up and pay attention because there could be information lurking in the weirdness. This movement in yields tells us something more important was going on than just the mid US data. That something is that people got too pessimistic on the banking blowup systemic risk and Fed Governor Waller stormed in at the end of the week and jammed yields higher with a strong hawkish message.

When you see headlines from Fed Governors and other Fed talking heads, you need to have context on who the person is. There is a constant cacophony of Fedspeak and most of it is useless noise. Waller is not noise. He’s one of the most respected voices at the Fed. And he isn’t ready to stop raising rates yet.

Speaking of Waller… Do you live and work in the Sarasota area? I will be presenting at the GIC conference there along with some big names like… Fed Governor Christopher Waller. It’s April 20 and 21 and, for reasons I cannot understand, it’s free! Sign up here:

https://www.interdependence.org/events/browse/cryptocurrency-and-the-future-of-global-finance/

Fed speeches are boring, but useful. If you care about economics and markets, you should plug your nose and read them—even if you kinda don’t really want to. Here are the two most important Fed speeches this week. People are generally lazy, so not being lazy is a simple source of edge in markets and in life.

Waller Speech. Hawkish.

Goolsbee speech. Dovish.

Fiat Currencies

The market wants to sell the USD and the trade was working well until today. But Waller, upbeat bank earnings, raging equity markets, and higher yields all conspired to make USD shorts grumpy into the weekend. You will often notice on Fridays that popular positions get a kick in the teeth as fast money (hedge funds, bank punters) reduce exposure into the weekend.

Less risk into the weekend is good for your mental health as a trader and reduces gap risk. It’s smart. Every six months or so there is a huge weekend headline and markets gap. They can reopen at totally different levels than where they closed on Friday. This can be expensive. Gap risk is one of the scariest risks in trading because you can’t measure it.

Dollar Index this week

.

Crypto

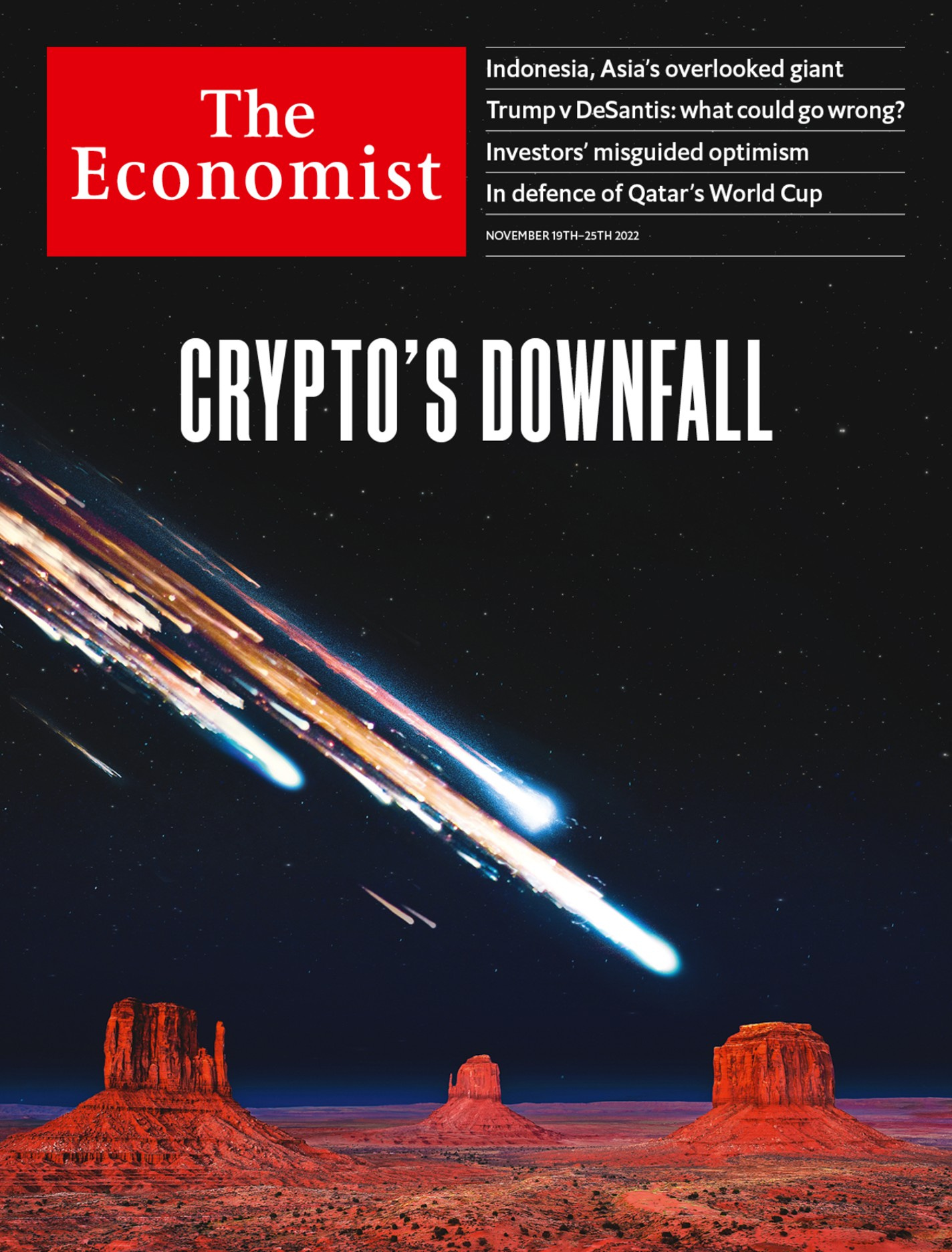

It was game over for crypto after FTX went Tango Uniform, right? I mean, The Economist even said so. On November 19, 2022.

Erm…. See chart for their typical inverse clairvoyant timing. ETH has almost doubled since then, though it’s still >50% off compared to the 2021 bubble peak. Any way you slice it, crypto is killing it right now.

Oops, they did it again. ETH mid-2022 to now

The perception that the Fed is done raising rates was part of the recent crypto resurgence, so it will be interesting to see if crypto stays supported next week or is just lagging the broader narrative a bit (as it often does). In other words, with yields and the USD strengthening today and NASDAQ lower, the next $500 higher in ETH is going to be a lot tougher than the previous $500. Sometimes, crypto gets the macro memo a few days after tradfi.

Commodities

Commodities were zzz this week. Oil is still holding the gap from last Sunday. That’s impressive. As long as crude stays above $79 (the post-OPEC announcement low) it looks super bullish to me. Note that the top of the range is right here at $83 something something (longest red horizontal line on chart).

If we get jiggy up through $85, you are going to start seeing a lot of oil headlines and gas price inflation worries again. Rangebound commodities don’t matter much for macro. New highs and breakouts capture much attention.

NYMEX Crude Oil

Alright. That was exactly five minutes. You’re done.

Feedback and criticism are always welcome.

Get rich or have fun trying.

Links of the week

Neat / Sweet:

Sarah Katilyn with wise wise wisdom on love.

https://twitter.com/Sarah_Katilyn/status/1644158627974922240?s=20

.

Sad / Dark / Beautiful

https://bukowski.net/poems/a_smile_to_remember.php

.

Smart / Funny:

Sarah Katilyn on the mad dichotomy of life in 2023.

https://twitter.com/Sarah_Katilyn/status/1645554909809393664?s=20

.

Smart / Interesting:

This next link is the classic essay I mentioned at the start. It’s from 1975 and remains 100% relevant today.

An absolute must-read for everyone, in my opinion. It applies to many facets of life (sports, poker, academics, etc)… Applicable to much more than just investing and trading. If you don’t know if you’re trying to win, or trying not to lose… You won’t employ the correct strategies.

https://www.empirical.net/wp-content/uploads/2012/06/the_losers_game.pdf

.

Dumb / Maybe smart? / Funny:

.

Music

Chill, surf, psychedelic, background. Courtesy of BB’s Colorado Recommendation Engine.

Oh my... this is so good!!! Thanks Brent! Super refreshing, stripped down to pure relevance and even aesthetically pretty much final boss level!!

Hi! I can’t fully get this paragraph:

“The perception that the Fed is done raising rates was part of the recent crypto resurgence, so it will be interesting to see if crypto stays supported next week”

Having read your previous week post about BTC as a QE-policies hedge (rather than an inflation one) I can’t understand why the Fed having a relatively more dovish stance implies crypto will have a hard time going on with its current bull run.

Thank you for all the great content you post!