Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Global Macro

I was off in Maine last week, hence no Friday Speedrun on August 4th. And I will be in Canada next Friday so I guess it’s good this product is free so you can’t really complain. I mean… You can complain. But, like…

Yeah, so it’s been a pretty strange two weeks as my view (published 28JUL, here) was that burgeoning inflation pressure, a ton of strange under-the-hood microstructurey stuff, bearish seasonality, and a preponderance of headlines including phrases like: “Bears throw in the towel” created a nice setup to take a shot from the short side. I specifically advocated MSFT puts and short megatech vs. equal weight kinda stuff.

The point of this particular Substack is not to make forward-looking calls (that’s what I do in my actual job), but this view was super high conviction so I couldn’t help myself and I put the whole thing online for free and trumpeted it in here.

Note: There are plenty of times I have high conviction and I’m wrong. Also, the fact that I am taking a victory lap here could bode very poorly for my bearish view. See here for an explanation of “The Cheer Hedge.” Fist-pumping and victory laps usually come at the worst time.

The reason I am circling back to my original view is that I am surprised at how well it’s worked so far given the soft US CPI release and the extremely dovish comments from Williams and Harker. We now have three core Fed peeps endorsing rate cuts in 2024. This is new! This week offers a useful lesson for people who are just starting in the market. The lesson is: It doesn’t always have to make sense.

Markets can move for macro and exogenous (externally-driven) reasons. But they can also move because of endogenous reasons. Moves driven by endogenous factors are hard to explain because very often the only people that know about endogenous factors are market makers and institutional actors, while journalists and bloggers will always use hindsight to assign some kind of macro or economic logic to moves, even when that logic could be wildly off base. In this case, it seems like it could be as simple as:

There is no one left to buy overvalued tech in the short run.

We had a long period of unwinding of equity shorts in 2023. Then, the market finally embraced the long side. And then, specs embraced the AI echo bubble, and finally made one last hysterical lunge higher on the MSFT AI pricing news. The rejection of that story and fugly price action afterwards, and then subsequent bearish action after MSFT earnings showed the buyers had lost control and sellers had taken over.

There doesn’t always have to be a logical macro story, though people will backfit stories as prices move up and down. I even saw a few people this week saying “Oh, I guess interest rates finally matter for tech!” LOL.

Inflation is either dead, or it’s about to rage higher

I read FinTwit cover to cover last night and it’s amazing how half of FinTwit has high confidence inflation has been successfully eradicated while the other half has equal confidence that it’s at the front edge of a major reacceleration. And these are not silly randos with no street cred. There are pros I respect on both sides. For example:

Team Disinflation

https://twitter.com/RobinBrooksIIF/status/1689628072150990848?s=20

https://twitter.com/fundstrat/status/1689003797975273473?s=20

Team Reacceleration

https://twitter.com/BobEUnlimited/status/1689593308262039552?s=20

https://twitter.com/nglinsman/status/1689657692455837696?s=20

We don’t know how this thing works

One of the amazing things when you talk to former Fed officials, or read speeches like this one from an ex-Fed official… Is that once people leave the Fed, they admit what everyone already knows: Nobody understands how inflation works. You can line up 200 PhD's over here and 200 over there and they will argue all night about what drove this inflation or why it’s going away or about to reaccelerate etc. Then, after something happens, half of them will be right and they will high-five and honk their horns and do book signings, and the other half will grumble and explain why they were right but some confounding variable interfered etc.

Then, next cycle, a different group of economists will be right for totally different reasons (or everyone will be wrong) and we start over again, realizing that the thing we thought made sense… Doesn’t. Nobody has a reliable framework that consistently explains inflation in advance. Most of the people that got inflation right this cycle got it wrong from 2010 to 2020. It’s complicated AF.

Remember the panic over QE and hyperinflation!? This was a big deal back in 2010: https://www.wsj.com/articles/BL-REB-12460

For now, a decent working theory is that monetary policy causes asset price inflation and procyclical fiscal policy causes goods and services and wage inflation. That kinda makes sense! Then again, there was a confounding variable this cycle: COVID. You will see all kinds of post-facto analysis breaking down the 2021 inflation like 2.5% was supply chains, and 1.7% was fiscal etc… Sure. Maybe. Anytime you read anything super confident-sounding about how inflation works, question the author’s humility and assume they are probably a tad overconfident.

Every cycle is wildly different and every model of inflation (Phillips Curve, Expectations Channel, Balance Sheet expansion, Supply Chain slack, etc.) works great in hindsight and poorly out of sample.

In conclusion… Inflation is either dead, or it’s about to reaccelerate faster than Lightning McQueen. Lots of people think they know, but nobody actually knows. I lean toward the reacceleration narrative because of energy prices, and rising rents.

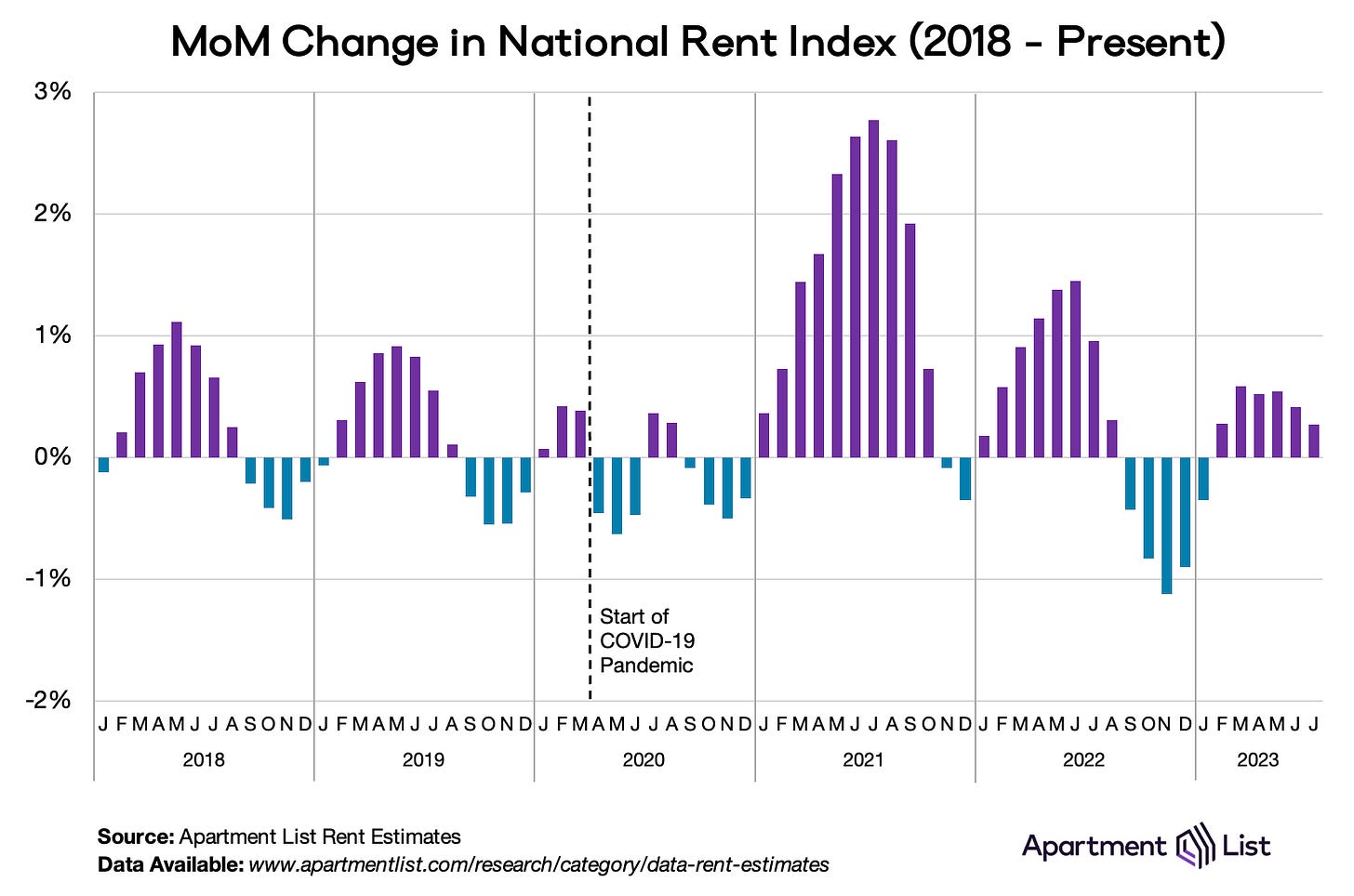

For the last six months, rents have been rising and NYC rents (for example) just hit a new all-time high. The official CPI data uses super laggy rent and housing inputs so the late 2022 drops in rents will first flow through the official data for a while but then rising rents and rising energy prices will again prove inflationary down the road. Markets are forward-looking and are perhaps sniffing out that anyone sounding the all-clear on inflation might be doing the GWB 2003 thing.

Stocks

As discussed a bit earlier… When things get bubbly, the turn can simply be the result of no more buyers. Sounds stupid, but it’s true.

The target zone for short-term MSFT shorts is 294/304. $294 is the big level; that’s the red horizontal line in the chart below. It joins the August 2022 high (old resistance, which broke cleanly, now becomes major support) and the huge gappy ripper breakout on earnings at the end of April 2023. A daily close below $294 takes out the entire AI bubble move and opens up 230.

MSFT Common Stock, May 2022 to now

Meanwhile, if NVDA gets below $375, there is a precipice of sorts for bulls to navigate as the stock gapped higher from $318 to $375 on that cray cray blowaway earnings day back in May. A daily close below $375 means that everyone that bought NVDA after that earnings release is in the red and that puts the pressure on late-entering bulls who were waiting for an influx of greater fools that never arrived.

NVDA earnings gap $318 to $375

Here is this week’s 14-word stock market summary: AI is an echo bubble. Mean reversion has begun. Stay nimble. Don’t be perma-anything.

In case you are wondering, I just learned this: Hyphenated words count as one word. So even something like “better-than-expected” is considered one word, not three. Learning!

Bonds

One might think that the end of inflation and the end of the Fed cycle would be good for bonds?! It has not been. Of course, if you believe that inflation is accelerating, you might also believe that the Fed is wrong to pause into a reacceleration of inflation and then you would sell your bonds, not buy. This seems to be what is happening, though this is one of those ex-post explanations that’s a bit of a kludgey fit.

US 10-year yield (black) and 2-year yield (blue) grinding back towards, but not through the prior highs

Bond market price action is not always easy to understand. Sometimes it’s about fundamentals, but sometimes it’s just about supply and demand. It could be as simple as this: The Fitch downgrade rattled a central bank somewhere and they decided to pare down exposure to the USA a bit, just in case. If investors don’t trust the US government to do the right thing on spending and they don’t trust the central bank to hold the line on monetary policy… They sell the bonds.

These changes in investor preferences happen slowly, at the margin, in conjunction with economic data releases, treasury issuance (supply), global rate moves (30-year Japan, for example), and other factors. Sometimes it’s easy to tell what’s going on in rates, sometimes it’s complicated.

When bonds sell off on credit risk, some will say the bond vigilantes are back. For a full deep dive on what it might mean if the bond vigilantes return to the USA after a few decades in hibernation, you can read today’s am/FX for free. There are some other topics covered in there too, like AGI.

https://www.spectramarkets.com/amfx/wen-vigilantes/

If you like that writeup, or Friday Speedrun, or just my vibes in general, you might as well just get up off your puffy chair and subscribe to am/FX.

www.spectramarkets.com/subscribe.

The number one lesson from every study of terminally-ill hospital patients: You regret what you don’t do, not what you do. That includes subscribing to am/FX.

Fiat Currencies

Nobody wants to be long dollars these days because the Fitch downgrade reminded everyone of the straight-up bonkers fiscal situation in the USA but that USD-negative bias has been costly. The USD trades well in a climate of rising global yields because US rate vol tends to be higher than most other countries and so if global rates go up, USA usually goes up the most. You see this over events where the BOJ will loosen up YCC and US yields move more than Japanese yields. This makes sense. It’s easier for US 10s to go from 4.00 to 4.10 than it is for Japanese 10s to go from .56 to .66. Starting points matter.

Sidenote: I feel like “starting points matter” should be a cliché in finance, but it isn’t. They do matter, a lot! For example, people were freaking out about M2 going negative YoY in 2023. That had never happened before. But M2 went from 15.7 trillion to 21.7 trillion from 2020 to 2022. Then it dropped from 21.7 to 20.7 in 2023 and people were like “IT’S NeVEr GoNE neGAtIVe BeFOre!”

Well, true but it also never went up 33% in two years before, either. The YoY decline, when placed in proper context, is meaningless. M2 is still well above trend. This sort of attention to numeracy can steer you clear of a lot of permabear commentariat traps. Always think about starting points, levels, and overall context… YoY isn’t always the most accurate way to look at a data set, especially after a once-in-a-lifetime economic shock.

Like, imagine a guy in a space suit flies up to the edge of the atmosphere, then falls back down 10% of how much he went up. Are you worried about him crashing into the earth? If something goes up a grillion percent one year, then drops 8% the next year, is that bad? Is that a collapse worthy of consideration? Or is it just a mean reversion / base effect / starting point issue? The latter, I would argue strongly.

OK sorry for the rants this week. As Abraham Lincoln famously wrote back in 1863:

“The chronicler of thoughts and musings, once gripped by COVID, oft harbors greater ire than he might’ve expressed had the malady not afflicted his spirit.”

Crypto

Every week or month there is another lunatic get-rich-quick scheme unveiled in cryptoland and while I am always about keeping an open mind, some of this stuff defies even the most cynical views. There is recent speculation that the BALD rugpull is linked to Alameda (errm… aren’t those assets supposed to be frozen?).

This week, the hype is all about friendtech. This is a crypto scheme similar to bitclout, but built on Coinbase’s L2 network (Base). I mean, it sounds like either a cool idea or maybe another hare-brained self-referential, Rube Goldbergian ouroboros machine.

At its core, Friends Tech allows users to buy and sell shares of people on the app. These shares operate similarly to other digital assets, bearing the potential for volatility. For instance, a user could purchase the shares of another at a price of 0.1E. If the floor price of those shares jumps to 0.5E soon after, the initial buyer stands to make a profit by selling at the new higher rate. Conversely, the risk remains that the floor price could decline, leading to potential losses.

Unlike traditional assets, the pricing model for these personal shares is based on a quadratic relationship. The cost of the next share is derived from the equation: S^2 / 16000 * 1 ether, where ‘S’ represents the current number of shares a person possesses.

It’s just math!

I am an optimist by nature but after five years of this bullshit, the burden of proof is firmly on the projects now. Anyway, I’m not here to criticize friendtech! Maybe this is the crypto use case we’ve all been waiting for and it’s not just Bitclout 2.0 or a complex MLM system in high-tech garb.

Bet on cryptofamous popularity in a Coinbase-built ecosystem! Why not. Buying and selling shares in human beings has often sounded like the dystopian endgame pitched by maxi-tokenization proponents like Balaji. So it will appeal to certain groups, for sure. Your value can be determined in the market! Nobody has to even know you; they can just judge you by your token value. Supercool!

“The more trading and speculation on you, the more money you make,” tweeted Coinbase’s Senior Staff Software Engineer Yuga Cohler.

My instinct is to believe that while there are 5%-10% true believers in these projects (like the genuine community in PEPE, for example), the majority are just randos surfing the wave and looking for the last few get-rich-quick flips before the regulators shut down the altcoin grift machine for good.

I am not an expert in friendtech, though. happy to hear why this time is different.

Commodities

Due to multiple rants, this edition of FSR is longer-than-usual. So I’ll keep the commodities section brief.

Energy prices are going up.

RBOB Gasoline

Precious metals are sucking wind as real interest rates make them unattractive and 5+% T-Bills make gold an incredibly expensive safe haven compared to risk-free government paper. People are logically fleeing gold and buying T-Bills. That said, gold and crypto both have held up incredibly well so far in the face of dramatically higher nominal and real yields. Maybe that’s a tell—or maybe they’re just lagging. I don’t have a strong view on either right now.

Alright. That was around 8.5 minutes. You’re done. No Friday Speedrun next week as I’m driving to C, eh? N, eh? D, eh?

Get rich or have fun trying.

Links of the week

Interesting / smart

This sounds boring, but it’s not. I strongly recommend it for peeps of all experience levels. Some nice empirical analysis.

https://elmwealth.com/cut-losses-early-let-profits-run/

Good free newsletter if you’re into poker

https://newsletter.philgalfond.com/subscribe

Music

I have been kind of obsessed with Post Malone’s music since April 2020 when he did the Nirvana tribute. Until that time, I wrongly thought Posty was an autotune pop music guy, and now that I know the truth (he’s a living, breathing badass rock star with a heart of pure gold)… I’m finding all kinds of cool stuff. I like when I’m totally wrong about something and find out I’m wrong.

Like, I also thought fishing was stupid, until I tried it…

Here is Austin Post doing a cool Bob Dylan cover before the face tattoos:

And here’s Post Malone doing Pearl Jam’s Better Man. His brother memories are nice. A cover isn’t supposed to be a copy, so don’t expect it to sound like Eddie Vedder. It sounds like Post Malone.

And Lithium by Nirvana. Again, it’s not Kurt. It’s Post Malone.

And if you have an hour and a bit…

Your writing is just such a pleasure to read! This newsletter is quickly approaching the Matt-Levine-quality-stratosphere (one word), weaving information, educated insights and genuinely funny commentary together in a way that's engaging and informative. I love it.

It looks like I'm turning into a groupie here, but whatever... I might miss the Run on some late Fridays, but it still reads like fresh rolls on a Monday morning. Thank you. It's so refreshing to have someone who just seems to make a whole lot of sense. BOOM!