Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Global Macro

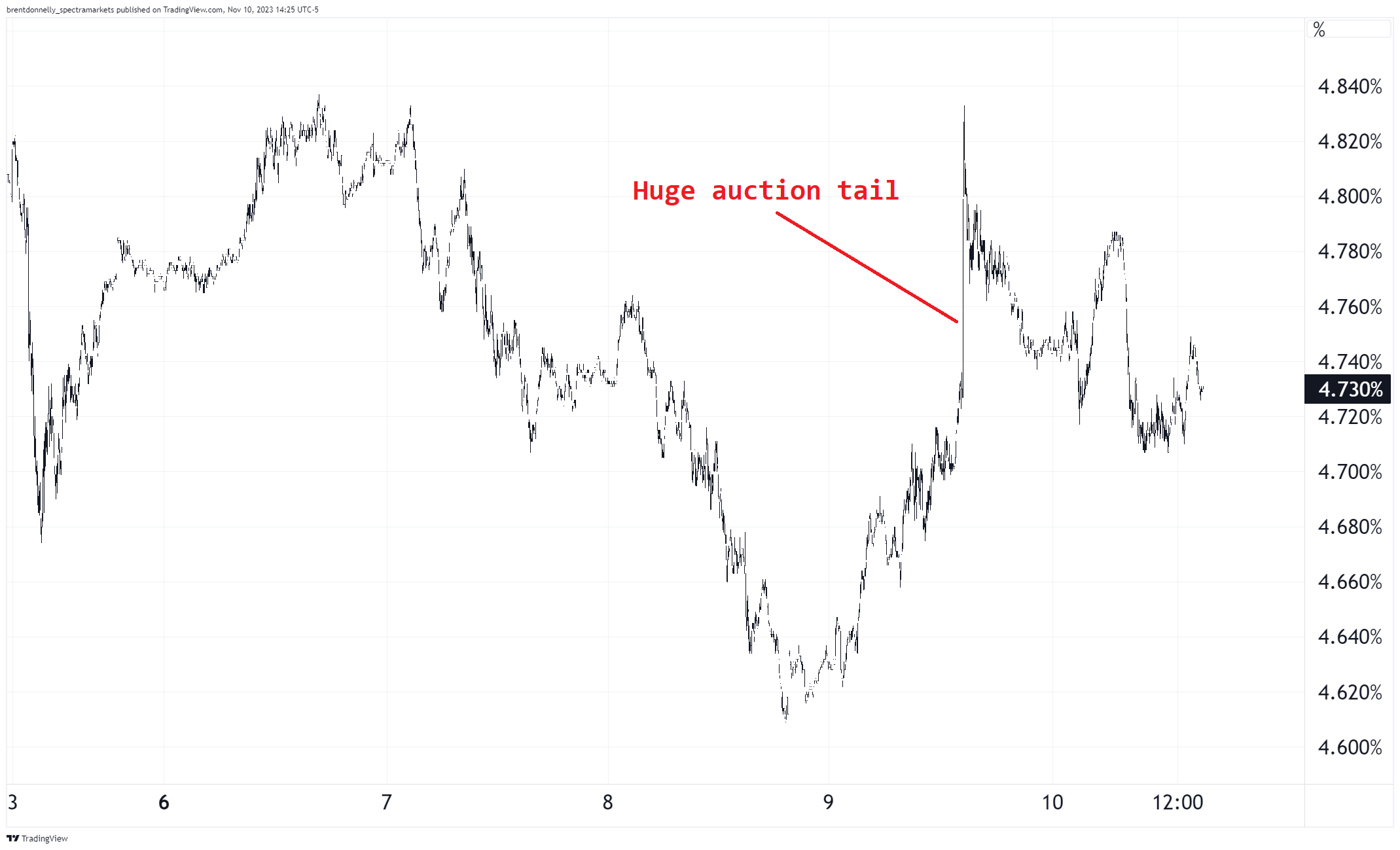

There was a really bad bond auction this week which put a temporary dent in the bacchanalia but had no lasting impact on yields or risky assets. The signal from the Fed and Treasury that they are willing to adjust issuance and monetary policy after long-term yields breached 5% remains the dominant story even though the really, really bad bond auction was not nice to look at.

Crypto is so back. After a year of slumber and an amazing ability to withstand a series of frauds and systemic shocks in 2022 and 2023, crypto as an asset class is reemerging as the ultimate Wall Street insider, Blackrock, embraces the ultimate outsider asset. This is a fascinating era and those who religiously despise or embrace BTC have had some crazy ups and downs!

Stocks are also staging an impressive rally and the path of least resistance is always up, up, and away in November and December. It doesn’t always work that way, but the probabilities are heavily skewed.

I had a nice convo with Tony Greer about macro and other stuff today. You can hear it right here.

Stocks

The S&P 500 was streaking like Will Ferrell through the quad with seven straight up days but hit a temporary wall after the horrendous bond auction on Thursday. The journalistic recaps suggested Powell was hawkish but I don’t really agree. I think the Fed will keep saying the same thing for ages now. “We’re in our happy place and it’s going to take a lot for us to hike, or cut.” The best recipe for them is to hold rates here for as long as possible until it’s completely obvious they need to move.

So the daily looks like this:

SPX Daily August 2022 to now

But you can see there was a 1% drop’s worth of fear for a few hours on Thursday if you look at the 5-minute chart. You can also see on that chart how 4320/40 is an important little support zone after the gap higher open that held on 02NOV and was retested 06NOV and in Thursday’s sea of red. If you’re trading from the long side, that’s a good pivot. Let’s say you’re risking 100 handles here to make 200 in coming weeks.

SPX 5-minute back to 01NOV

The goliaths like NVDA and MSFT have fully recovered from what looked like peak AI mania and are now not super far from making new ATHs. MSFT is in fact making a new record all-time high as I type this. Incredibly impressive.

Here is this week’s 14-word stock market summary: One bad auction is not enough to stop the short covering and benchmark chasing.

Interest Rates

As mentioned at the top of the show, we had a really bad 30-year bond auction this week. Here’s what 30-year yields did.

US 30-year yield, 5-minute chart over the past 10 days

It’s interesting to me that yields are right back where they started. That’s a good showing overall despite the spike in yields and if you’re long bonds you’re feeling a lot better today than you felt yesterday.

My guess is we get a boring range in yields now as the data is just bad enough and policymakers are just awake enough to keep stuff from ripping to new highs but there is enough economic and stock market strength to keep yields from tanking.

Next week’s CPI and Retail Sales data will be closely watched and I think Retail Sales is most important as the death of the US consumer is always on everyone's radar, especially with Christmas season approaching.

Fiat Currencies

The dollar, like Miley Cyrus, remains a wrecking ball, even as yields have calmed down significantly. The general relationship has been that yields and the USD have been dancing back and forth but the dollar is holding up very well considering where yields are. There seem to be very few environments or regimes where the USD goes down for more than a day or three.

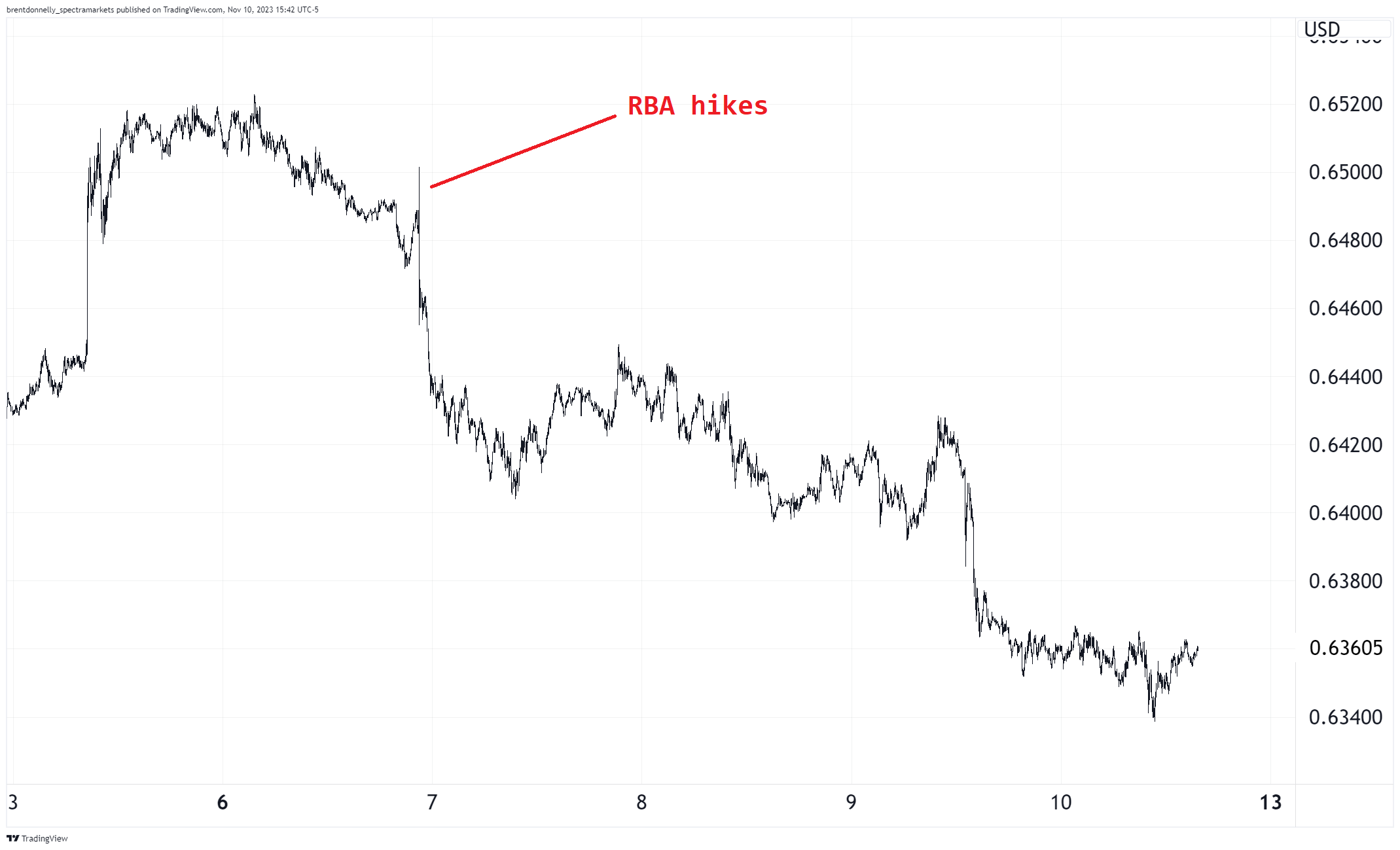

The market (including me) took a punt on AUD higher this week into the Reserve Bank of Australia (RBA) meeting and the RBA hiked and the currency did this:

AUDUSD is not impressed with the RBA (5-minute chart)

There are easier years and hard years in FX and this is one of the hardest in a while. Volatility is low, nothing is following through, themes are confusing, and crosswinds are plenty. Sometimes the thing in trading is just to survive the near-impossible times so that you can make hay again when the sun comes out.

The market has been trying to sell USDJPY basically all year for various reasons including US recession and BOJ normalization and as bearish as the market was at 137 the market is now equally bullish at 151.50. With volatility low across the board, the market just wants anything with carry and USDJPY certainly fits that as the BOJ is moving paleolithically slow while the Fed hiked a grillion percent this year and so parking your money in US T-bills or bonds is a lot better than leaving it in JGBs. Even the large-by-JGB standards move in Japanese yields barely makes a dent in the US dollar’s yields advantage.

The market really wants The Big Short Dollar trade, but they aren’t getting it. Every time the dollar looks down, it stands back up and throws a flurry of hard right hooks to the jaw of deficit-watching dollar bears. One day, maybe!

Crypto

Guest commentary from Sol Ehrlich

I haven’t commented on the price of BTC for the past 3 months, as there’s been little to say. I bought the dip at the end of August and end of September, and just bled funding costs, got stopped out, got back in, etc. The average entry was 26.4. Now that we’re apparently back to life, it’s time for me to jump back in.

First, I’d like to cite the most brutal force of nature, The Cheer Hedge. BTC hit its yearly high at 37.9, and one hour later I received a text congratulating me on my long. Dang.

Second, we have a layered sell wall on Okx starting at 38.5. Courtesy of bitcoindata21.

This makes sense fundamentally as we enter the overhead supply zone (between 38-40k) from before Terra collapsed in May ’22. Of course, a rip through this sell wall would completely invalidate my view.

Third, is seasonality. As Brent specified in his am/FX, the 20 trading days after Nov 8 are historically bearish for BTC. Like stocks, the secular trend in BTC is up, so a 20-day sample of negative returns is potentially significant. I’d argue that this happens due to profit-taking/mean reversion from historically bullish Octobers, with the exceptions being raging bull markets. We could very well be in one, but I wouldn’t call it raging like 2017 or 2020.

Fourth is the elephant in the room, the ETF and “buy rumor, sell fact.” My base case is two scenarios. As we pass the comment window from Nov9-17, the SEC can approve or not approve the ETF. If they don’t approve it, my suspicion is that market participants will get bored, and the euphoric narrative and price action will slowly fade. To where is anyone’s guess, and I would need more information when that time comes.

If they do approve it, speculative inflows and institutional buying will only carry us higher until the demand from this narrative is no longer priced. I think we’ll need greater tailwinds to take us to new ATHs.

I’d add that there were plenty of bullish arguments before The Merge and Shanghai upgrade too, but if there was no bullish narrative, people wouldn’t have bought in anticipation in the first place.

Commodities

Gold and oil are making people annoyed these days as the great breakouts that always feel imminent at the highs continue to fail. Gold looked super crazy bid on the Middle East stuff but the half life of geopolitical scares is pretty short, generally and gold can’t quite muster the energy to challenge the critical all time high triple top at 2080. The chart is kind of a mess as we’re midrange.

Gold hourly, April 2023 to now

And oil is also midrange as for whatever reason people are getting more worried about demand than supply as markets have forgotten about Russia/Ukraine and are quickly forgetting about the risk of Iran joining the Middle Eastern fray.

So it all makes for a boring market in those two products even as coffee and OJ and wheat and other things are going wild in different directions. It’s nice to see gasoline prices stable, at least as they play directly into consumer psychology. Used car prices are also way off the highs, back to early 2022 levels. Prices do sometimes go down!

OK! That was 5.44325 minutes. Please share this Substack with any aspiring finance professionals that you know! Thanks!

Get rich or have fun trying.

Links of the week

A cool thing

https://x.com/donnelly_brent/status/1722438996658143551?s=20

Thanks Brent.

Interesting to see the MXN carry trade breakdown with treasuries at the time of the bad auction. Also interesting that there was a hack of a Chinese bank which could have been the cause of the bad auction, maybe that’s why it was priced out Friday & stocks resumed the rally.

Apple broke out of a riding wedge before the index & looks like it’s off to the races.

thanks