Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Global Macro

There was no Friday Speedrun last week because I was traveling, but the China reopening nothingburger I discussed last time has now morphed into “China slowdown!” and the return of US Exceptionalism. There was this strong feeling coming into 2023 that the US was going to slow down as the 17 Red Bulls the American economy funneled in 2021 finally wore off.

This view led to a few core macro ideas:

China reopening will spur the global manufacturing cycle.

This will trigger demand for commodities.

This will take European growth up, up, and away.

Rapid rate hikes would prove too much for the US economy and it should be in recession by April or May 2023.

Fed will cut rates in July or September 2023.

.

Let’s mark those ideas to market:

Wrong. Incorrect. No. Nope. No.

Instead, US Exceptionalism, the theme that dominated much of the period from 2012 to 2021, came back like Michael Myers at the end of a Halloween movie.

Ready to kill the equity shorts and eviscerate USD bears.

I am NASDAQ. I will not die.

And while the US rolls around in a bathtub full of $100 bills printed by the AI, Germany is in recession, Asian exports are slumping, global manufacturing is contracting and America’s fortes, tech and services, are strong, and stronger.

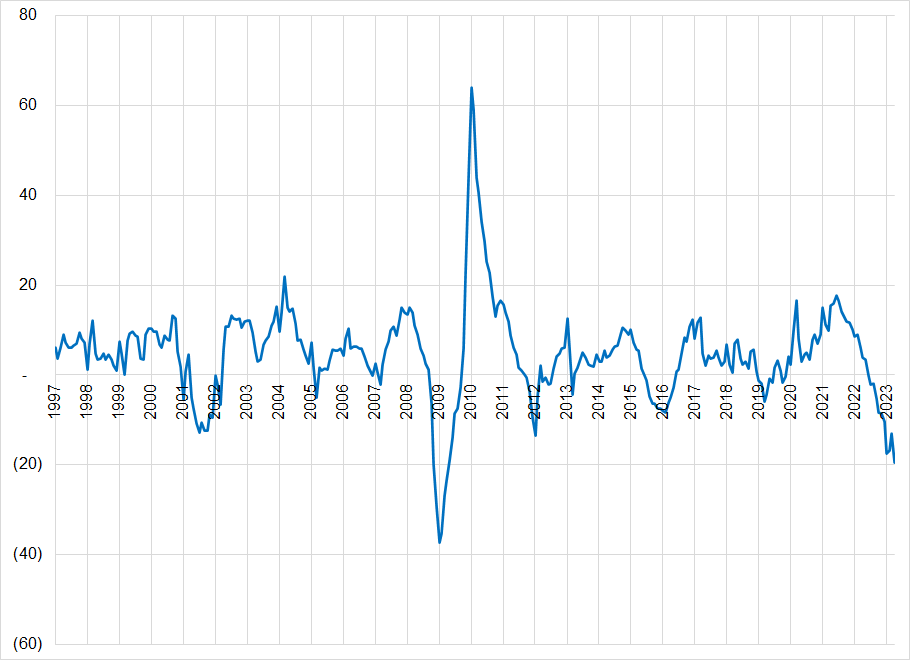

There are a ton of charts I could choose, but let me show you Taiwan Industrial Production. German data looks similar, as does much of the export data in Asia. 2001 and 2008 were major recessions.

Taiwan Industrial Production, YoY change (%)

The fall of Silvergate and Silicon Valley bank, et al. feels like a distant memory.

While most still contend that economic pain is coming, and I agree, that’s not a useful framework for making money. Everyone found that out in 2006 and 2007, when it was “obvious” a credit debacle and housing bubble burst were going to tank the US economy.

SOOOO many hedge fund managers and individual investors and bank traders got rekt in 2006 and 2007 trading the “inevitable” collapse that only came more than two years after the first yield curve inversion in mid-2006.

Early = wrong.

AD

am/FX is my daily macro note that goes to a couple of thousand traders and investors. Learn more, faster. Subscribe here.

END OF AD

Stocks

Stocks are stoking a lot of angst because most people are neutral or bearish and most everyone has agreed that hanging out in T-bills at 5% is the best way to avoid the inevitable derating of the US stock market.

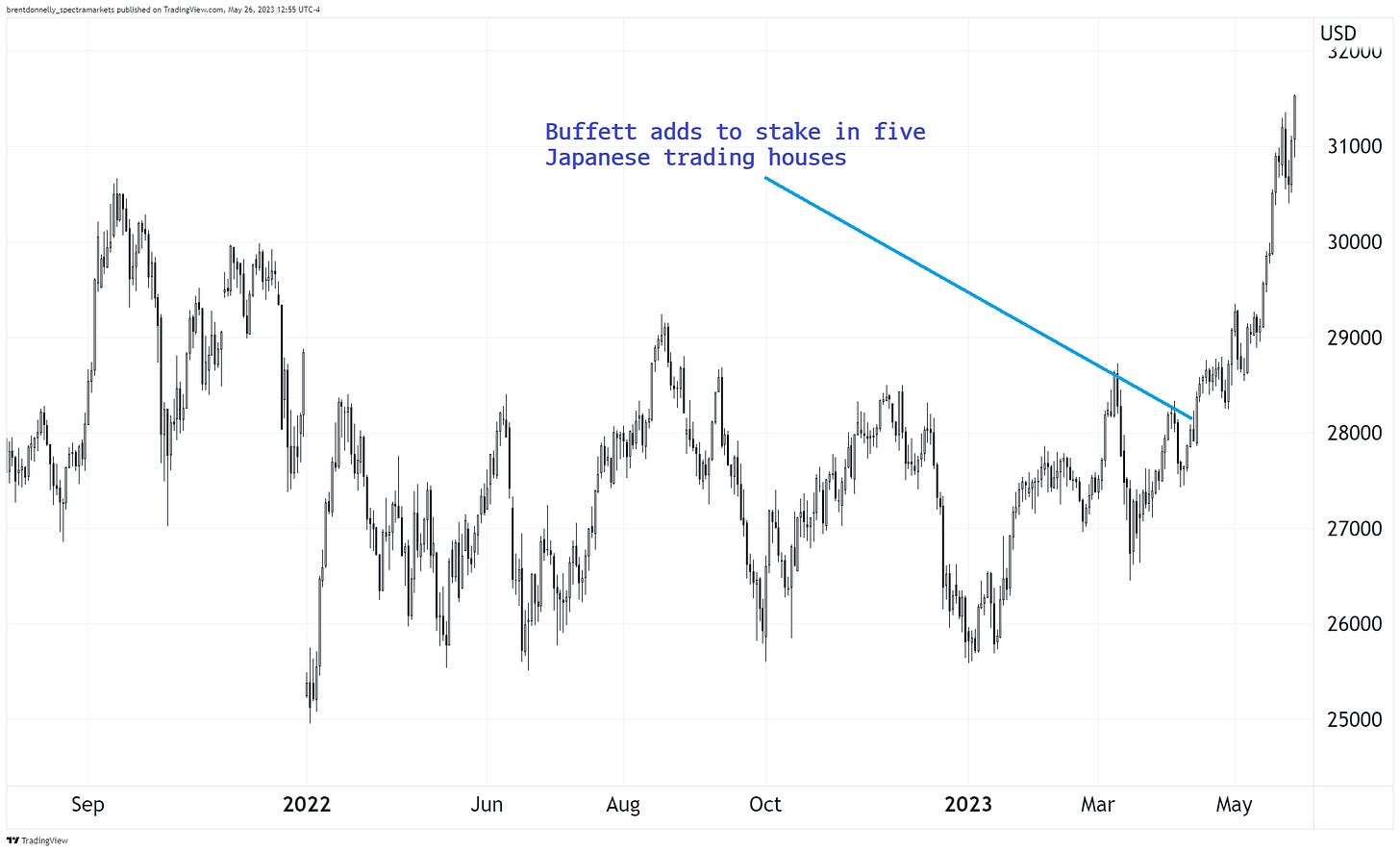

Instead, the main macro theme is US exceptionalism, with a side of Japanese.

Japan Nikkei 225 Index

That Warren Buffett kid seems to know what he’s doing!

While equity indexes are burbling up towards high water, the only story that anyone cared about in stocks this week was NVDA. It is not every day that a megacap rallies >25%!

To give you some context, here are daily $ price changes in NVDA back to 2015.

NVDA daily price change, 2015 to now ($)

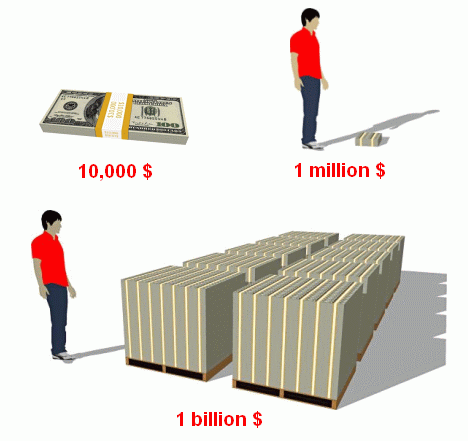

Often I would use % change here, but in this case, the absolute gigantitude of the market cap increase is the meaningful metric, not the % change. The stock rallied 85 bucks and there are 2.5 billion shares outstanding.

How much money is that? Let’s ask the GPT AI (powered by Nvidia™)

$212.5 billion is a lot of dollars. Here’s what ONE BILLION looks like.

A theory of mine is that monetary policy and fiscal policy will become increasingly insane over the next few decades because the numbers have exited the realm of meaning and now are totally abstract. Nobody can imagine what a trillion dollars is, so there is literally no difference between a spending plan for $1 Trillion or $4 Trillion. It might as well be a spending plan for $1 Quuekzoolian.

After a certain point, the human imagination cannot comprehend large numbers and now that we are well beyond that point in the US economy, crazy stuff is feasible. Like the 2021 fiscal spending and balance sheet expansion.

This is the long-term bull case for bitcoin in one paragraph, BTW. And the premise of this rather dark novel, which is a solid summer read.

And here is this week’s 14-word summary of stocks:

NVDA moonshot. Japan and NASDAQ booming. DAX holding in. Hang Seng weak AF.

The ethics of dunking

On Thursday, I posted this, which shows that ARKK sold all their NVDA at the lows.

That’s not a very nice thing to post and generally, I very, very rarely go negative on Twitter. I sell at the lows too sometimes! That’s part of trading and not a big deal. I don’t dunk on anyone for being wrong, ever, with this singular exception.

In this case, I believe ARKK is fair game because of its role in fueling the 2021 bubble with intentionally ludicrous price targets, FOMO-stoking narratives, and other silly pom-pom waving that directly cost a lot of people a disastrous amount of money. The lead ARKK managers were around in 1999/2000 and should have known better.

Their biggest call was TSLA, which is up 10X since 2018. The NASDAQ is up more than 2X since 2018. ARKK is flat since 2018. But they get to keep the fees.

I am wrong all the time, and funds make bad investments all the time and that’s trading and there is nothing wrong with that. But my view is that ARKK is open to criticism because of the direct role they played in inflating the 2021 bubbles.

Still, I would not call you unreasonable if you said my tweet about ARKK is mean-spirited or unprofessional.

Bonds

This section is called bonds, but it should really be called “rates.” That is, I’m going to talk about monetary policy in here, not just bond prices. Bonds and monetary policy are intimately connected but can diverge. But “bonds” is just a clearer heading. That was a very boring paragraph.

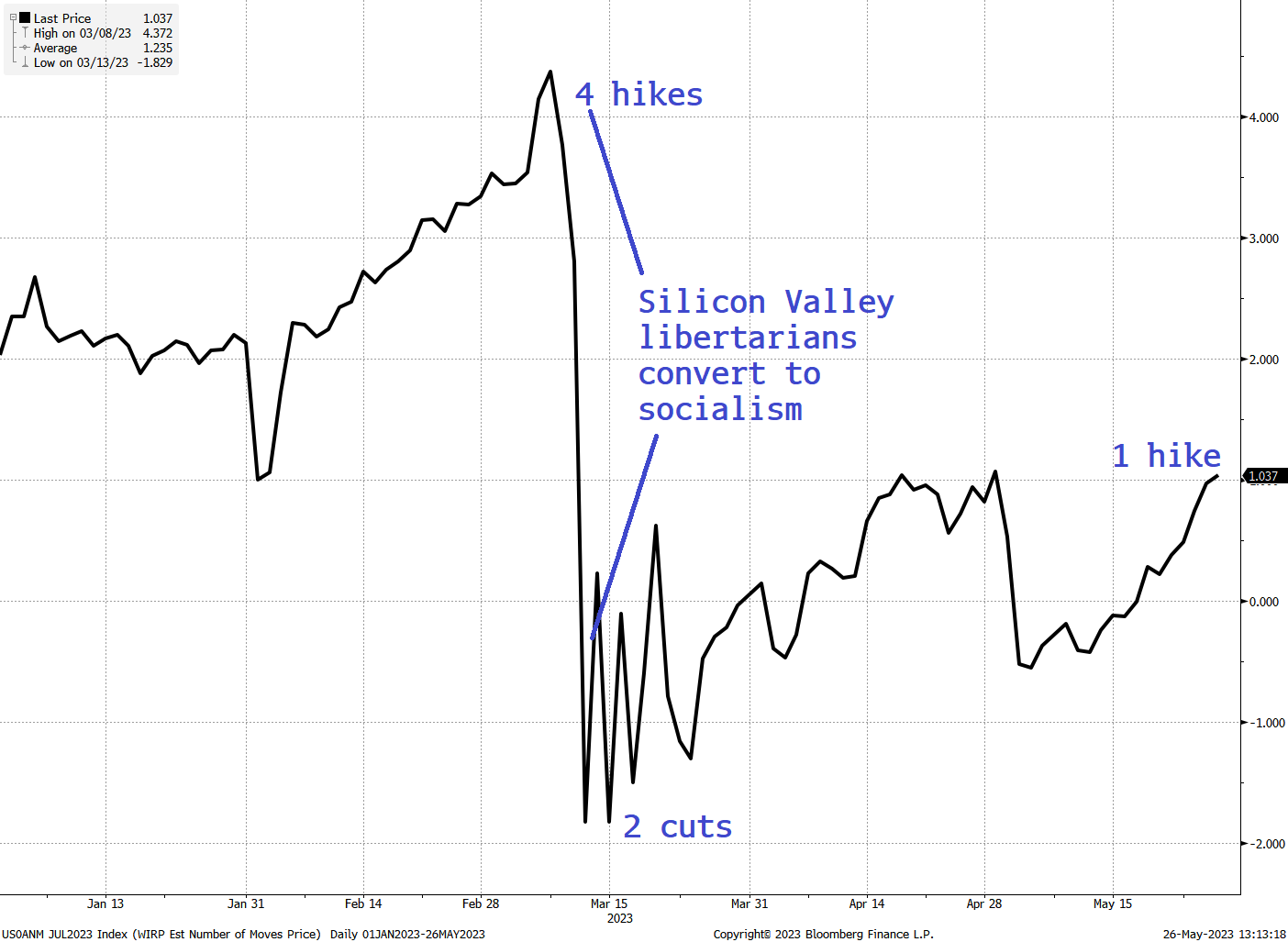

The market thought the Fed was gonna hike a lot this year, then fires started breaking out at various discos like Club Silvergate and FRC Soundbar and suddenly those hikes turned to cuts. The market reasonably embraced the idea that credit contraction would lead to bad economic outcomes in the US, but A has not yet led to B. And so now we are looking at Fed hikes again.

How many 25bp cuts or hikes are priced for the July 2023 Fed meeting?

It’s all about the data, and the US data refuses to capitulate. Today we got another sticky US inflation number, too.

Core PCE ex-housing es muy pegajoso

Fiat Currencies

US exceptionalism means a higher USD. It’s really that simple. If US equities and US yields are going up, you don’t need to guess what the USD is doing.

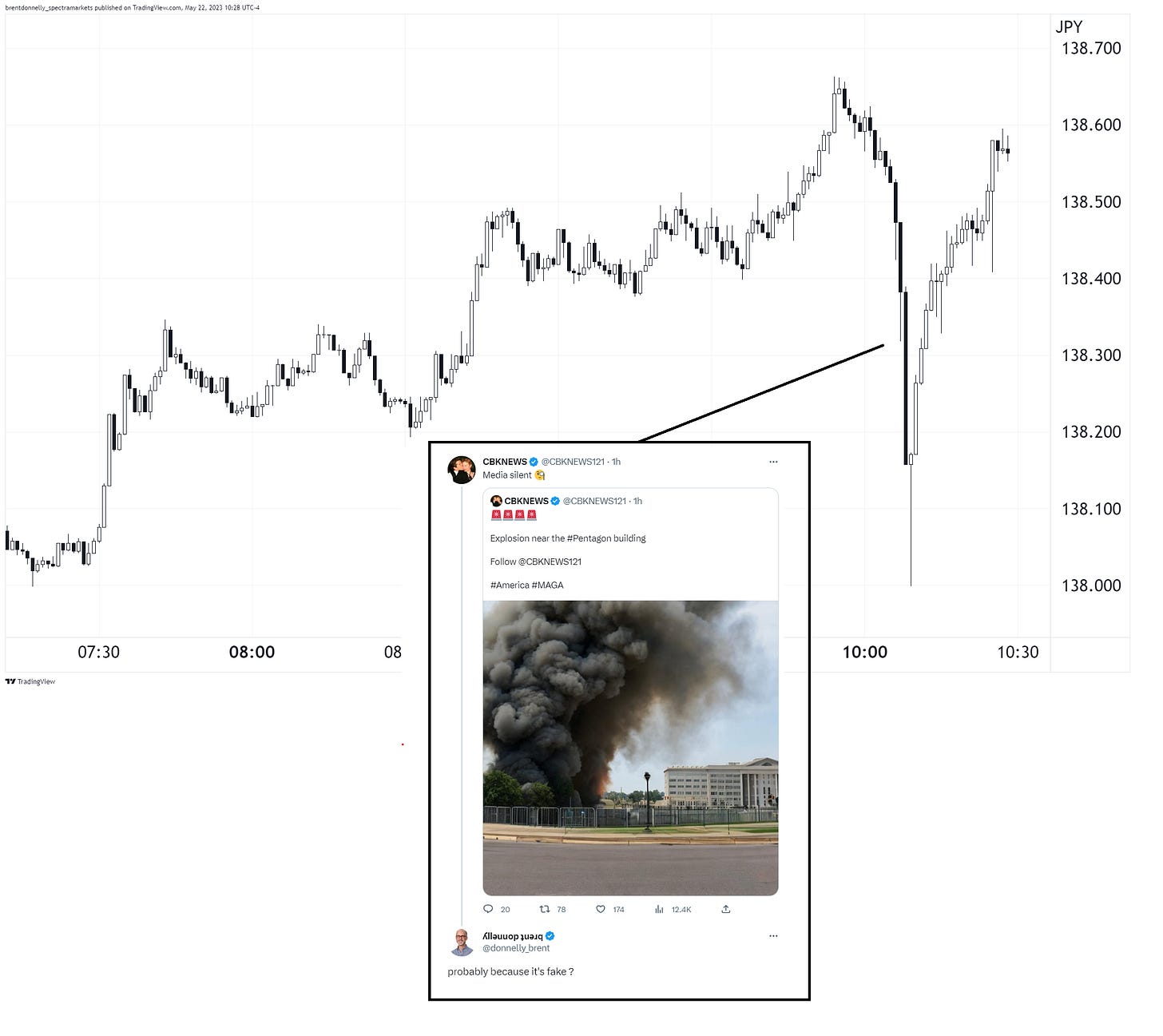

One random but interesting thing that happened in FX this week was some tool pumped out a fake news headline saying “Explosion near the Pentagon.” and USDJPY did this:

If you are a professional trader, there is a simple way to know if a headline like this is real. Count to 100 after you read the headline. If it’s not on Reuters or Bloomberg by the time you’re done counting, it’s fake.

If you are thinking: “Wow, I should send fake headlines and trade it and make lots of moneys!” Don’t. You are wrong. You should not do that. You will go to jail and spend approximately 44 months in prison.

Crypto

People have lost interest in crypto these days. There was the big memecoin push in PEPE etc., but overall volumes are in the toilet. 7-day average volumes are less than 50% of that now-tiny peak in 2018.

7-day combined exchange volumes from The Block

You can look at other metrics like DeFi activity and see a slightly less moribund picture, but overall there is not much speculative participation in mainstream crypto these days. Lotto ticket buyers have moved to AI stocks or PEPE, while tight monetary policy restricts demand, falling gold and the USD rally stifle the dedollarization hysteria, and HODLers sit on their sats and pray for the next MMT cycle to begin.

A decoupling of NASDAQ and bitcoin has been ongoing for a few weeks, but not in the direction that crypto bulls were hoping for.

Daily NASDAQ (blue line) Viagra formation while bitcoin swims in cold water

Commodities

Copper has been an important lead indicator all year because it’s a good proxy for both global growth and Chinese commodity demand. The gradual transition of China reopening from a major theme in January to complete nothingburger by May has been surprising.

Zooming in, I will point out that today’s rally in copper is worthy of attention. For copper to rally like that on no news and with the USD trading very strong … Might mean something for next week. If I had to guess, it probably means the USD trades lower next week (vs. AUD and CNH) and Asian equities bounce.

Prepare for the ouching

Saudi oil minister with a stern yet hilarious warning:

“I keep advising them that they will be ouching — they did ouch in April,” Saudi Energy Minister Prince Abdulaziz bin Salman said at the Qatar Economic Forum in Doha on Tuesday. “I don’t have to show them my cards and I’m not a poker player. But I’d tell them: ‘Watch out’.”

Funny.

Alright. That was 5 minutes! You’re done.

Get rich or have fun trying.

Links of the week

Cute fun nice

https://twitter.com/TheFigen_/status/1661060673432961026

This makes me uncomfortable

https://twitter.com/cameronwilson/status/1661146439270150144?s=20

Surgeon General’s warning on social media

https://www.hhs.gov/sites/default/files/sg-youth-mental-health-social-media-advisory.pdf

Better late than never. Social media collects profits for shareholders and externalizes costs to society. Like cigarette, gun, and opioid manufacturers do.

That got dark, fast.

Quick, look at this happy unicorn image to clear your mind of dark thoughts.

Music

MF Doom rhymes with the Icelandic volcano Eyjafjallajökull.

Wow, around the world with Brent Donnelly in 5 minutes! I'm dizzy, hahaha! Thank you!

Marvellous as ever Brent, thanks.