Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Global Macro

This week saw a continuation of a theme that has flashed off and on all year: Central banks appear to be hiking into or through the pain point of many economies, the soft data is getting worse, and markets barely care.

There have been so many instances where the soft sentiment data pointed to imminent calamity ahead… And yet here we are. Markets are mowing the lawn and that tornado has been out there on the horizon for months. Kind of like the always-lurking scary clown yield curve signal I described last week.

The issue with markets at this point, which was similar in 2006 and 2007, is that it’s too expensive to sit around and wait for some calamity that might never arrive. Yes, the crash finally came in 2008, but the market was in a similar position in 1994 as the Fed ripped rates higher and equities got nervous for a while.

That period was followed by one of the greatest 5-year bull markets in history. So while 2006/2007 is fresher in the mind, and everyone generally assumes soft landings are impossible… They’re not!

Much of the economic commentary at this point is just people guessing or feeling around in the dark to find data that supports their priors. Those who think inflation is coming down will point to Truflation, which shows US YoY inflation is around 2.4% while those who think the government is lying to us point to ShadowStats, which shows inflation around 12% YoY! The official figure is in between, around 5%.

The funny thing is that both those websites use a reasonable methodology to come up with their numbers. The methodologies can be debated, but the truth is that any inflation calculation requires the creation of a black box loaded with assumptions. Truflation has been around for about two years and their data shows no correlation to the official data.

Shadowstats uses methodologies from 1980 and 1990 to calculate inflation, arguing that the BLS keeps changing its approach to make it seem like inflation is lower than it really is. I would humbly suggest it’s mostly just useful to focus on the official data, whether you believe it or not. I did a huge deep dive into hedonic adjustment once upon a time and my conclusion was that … Yep, it’s a black box. You can make inflation whatever you want it to be, almost.

Which black box do you want to focus on?

The privately-developed one that has been around for two years and has no correlation to the official data?

The one that uses methodology developed 43 and 33 years ago?

The official one that the Fed watches?

For me, the answer is three. Privately-generated CPI data has been around for ages (e.g., MIT Billion Prices Project, Adobe Online Prices data, etc.) and it’s not a useful guide to where the public data is headed.

If you can predict where the official data is going by backing out lagging components like rent, that’s great. But watching private inflation data has been unuseful for my entire life and it’s not because the private data lacks sophistication. It’s because calculating inflation requires a billion assumptions and everyone is going to make different assumptions when they build their black box.

Another way that people make spurious observations about official data is by looking around and arguing that what they see right in front of their faces does not match the story told by the official data. This tweet is an all-time classic version of that:

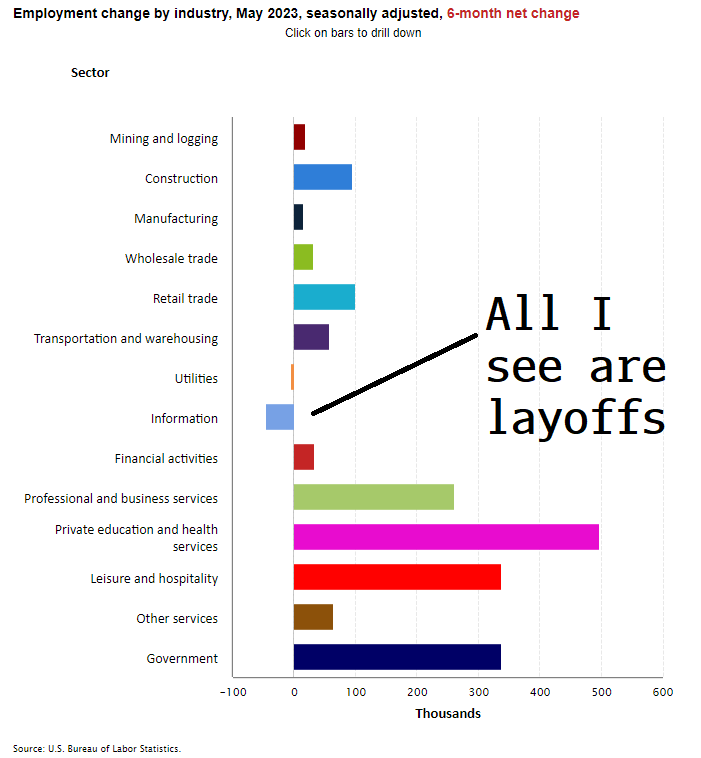

This is a venture capitalist saying all he sees are layoffs, and implying the government is just making shit up as they go along. Criticism of the jobs data is a perennial bloodsport, but normally the critics have some basis for their argument other than a quick look around at their own industry.

David Sacks works in technology. He sees a lot of layoffs. Technology represents about 5% of the US workforce. The tech layoffs do not move the needle.

This is a useful example of:

Confirmation bias (the government is bad so all government stats are sus)

Availability heuristic (my friends are getting laid off so the US economy must be shedding jobs like crazy)

Dunning-Kruger Effect (I am successful in tech, and I can apply that success as an expert in other domains like macroeconomic data analysis)

The point here is to always understand the bias embedded in what you read, because almost all content you consume, even financial commentary, is loaded with bias. Try to for your economic opinions by reading commentary from less biased experts like Noah Smith, Reuters, and Bob Elliott. Even those sources can be biased, of course, but the longer you track your sources, the better you will understand if they are flexible, open-minded, and unbiased. Or not.

The most credible economists in the world right now are the ones that are willing to say “I don’t know for sure what’s going on here, but this is what I think.” This economy is more convoluted, difficult to understand, and impossible to forecast than anything we’ve seen in our lifetimes. It’s a big, complex, nonlinear Rube Goldberg machine and the best forecasters will make strong arguments that are weakly held.

That was a bit of a rant, but I think this is important: a critical and underappreciated skill in economics, trading, and finance is the ability to curate the information you ingest and understand the bias of the person or organization delivering it. Otherwise, you risk getting fooled by disingenuous gaslighting, or tricked by smart-sounding permabears, or sucked into politically-motivated echo chambers.

Stocks

Not a great week for stocks, even as volatility continues to compress. US stocks were down 2%, Europe down 3%, and Asia more like 4-5%. Most of that is giveback from last week as the economic data underwhelms and the on-again/off-again infatuation with China continues.

Last week, it was all about China stimmies and rate cuts and this week it’s back to the reality of China as a heavily-indebted autocracy leaning more towards communism and away from capitalistic animal spirits. Large-scale stimulus is not happening as the authorities shy away from repeating past mistakes.

Tech and Japan are still within 2-3% of their 2023 highs, while Shanghai and the UK FTSE 100 are more like 7% off peak.

Barry Ritholz wrote a good article this week about why indexing is well-understood and superior for most investors. Barry tends to be pragmatic and often offers optimistic counterpoints to naysayers and permabears.

The main reason indexing outperforms over most time horizons, on average, is that it charges lower fees. It’s almost (but not quite) that simple. Lower fees, compounded over time = better returns.

This is a known argument in favor of passive over active and was made way back in the 1970’s by Charlie Ellis in his Loser’s Game essay. I recommended that essay at one point a few weeks ago in Friday Speedrun and believe it’s in the slim canon of absolute must-reads for all finance peeps. In 1975, he said:

He was absolutely correct in 1975 and is still correct today. If you don’t know exactly what your edge is when you actively manage your portfolio, you are leaking transaction costs and other fees and you are trading for no reason.

While Barry talks about fees in his article, he also offers other reasons for 50+ years of passive supremacy over active, including this one:

The challenge in selecting stocks is that the vast majority of them don’t move the needle. Academic research has shown most stocks don’t really matter; the typical stock may be up a bit or down a bit, while more than a few disasters crash and burn. But the big drivers of market returns are the 1.3% of publicly traded companies that put up those giant performance numbers over an extended period of time.

Can something like NVDA, which trades at 40X sales and a $1 trillion market cap offer giant performance numbers over an extended period of time? It’s hard to imagine it as a 3-bagger, let alone a 5- or 10-bagger. A 3-bagger would make Nvidia the most valuable company in the world right now. NVDA can definitely go higher, of course, but it’s not the kind of investment that is going to make or break your portfolio unless you are heavily concentrated in that one stock or it does something I cannot imagine like end up worth $10 trillion.

And every bubblette always needs a fawning, cult of personality, mainstream media piece on its founder. We got one on NVDA last week:

Portfolio performance comes from the 5- and 10- and 20-baggers. Not the 2-baggers. It also comes from avoiding the overpriced behemoths that crash and burn. Investing and trading always comes down to the question of edge. Assume you have no edge unless you can explain your edge clearly. If you’re buying NVDA here… What do you know that isn’t already priced in?

Here is this week’s 14-word stock market summary:

Consolidation and contracting volatility make for a somewhat unexciting week. Asia’s the high beta.

Bonds

The economic stalemate continues as plenty of arguments can be made for weakness down the road but right here, right now the central banks are still hiking. The Bank of England and Norges Bank (Norway) both hiked rates more than expected (50bps vs. 25 expected) and that kept a floor under yields while weak economic data out of Europe provided the cap.

Zagging: US 10-year yields, hourly back to June 9

Fiat Currencies

So the UK and Norway hiked more than expected. Their currencies must have done well right? Right?

Here’s EURNOK (up means stronger EUR and weaker NOK).

EURNOK, hourly chart this week

And here’s the Great British pound. I had to make this one a 5-minute chart so you can see the flickery spike there up to 1.2840. That move lasted about 2 1/2 minutes.

GBPUSD 5-minute chart this week

The orthodox explanation when a G10 central bank hikes and the currency goes down is that the central bank is hiking so much it will not just tame inflation, it will hurt the economy. The market has tried this playbook a few times, and the economies keep on trucking… But the market is keen to evaluate the precise pain point for the UK particularly because the thinking is that as variable-rate mortgages reset higher in the UK, they could trigger a massive consumer retreat and recession.

The problem with betting money on this narrative becomes obvious if you simply go to Google News and search for “UK mortgage resets.” You get these results on top:

As discussed last week with the scary clown and this week with the nearby tornado of weak sentiment data: good forecasts need a time condition. And ye olde “UK is toast” narrative has been brewing for almost a year now. Again, the view is probably accurate! Hopefully we’ll know it when we see it. When we do… There’s going to be one heck of a short the UK trade. Until then, UK shorts are expensive like Villebrequin.

Crypto

Bitcoin is alive again. Despite the drop in gold and rise in 2-year yields, the four-factor model described in “am/FX: What is a bitcoin?” still points to higher bitcoin because the NASDAQ has performed so incredibly well since then and that variable dominates.

The last push lower in bitcoin after the SEC filed charges against Binance and Coinbase looks to be a fake-out. The more cryptocurrencies are named as securities, the stronger the case for bitcoin as the OG store of value. As discussed last week in Friday Speedrun and before that in am/FX: if NYMEX went bankrupt, that’s not a good reason to sell crude oil! If the CBOE went bankrupt, you would not sell bonds.

You can see that the model showed the way in the second half of 2020, called “baloney” on that zippy dip in mid-2021, and turned sharply lower in April 2022 just before bitcoin dumped in May 2022… So it has had some good directional calls.

Bitcoin vs. 4-factor model (NASDAQ, gold, US 2-year yield, and DXY)

On the other hand, you could argue that low trading volumes in crypto and the emergence of AI in 2023 mean that a considerable amount of hot money has left the space and is seeking higher volatility elsewhere. NVDA continues to realize higher vol than bitcoin and 0DTE options are more fun than most altcoins, much of the time.

As such, I would speculate that some of the gap between the model and BTC is explained by the regime change in spec interest away from crypto and towards AI and thus will remain persistent. The flurry of spot bitcoin ETF applications has been priced for now and the interminable wait for SEC approval has begun. A decision by Jan/Feb 2024 is likely.

Commodities

Gold is making more sense to me down here as the debt ceiling insurance logic has expired and gold goes modestly lower. As long as we are below the triple top ($2080), US real yields are high, and T-bills are a nice risk-free safe haven yielding 5%… The short-term outlook for gold remains bearish. It’s a bit like bitcoin, where you want to buy dips in the big picture but avoid the extremes when everyone is piling in all giddy-like. The range is 1680/2080 until one day it finally explodes through 2100. Dip buyers might get lucky at 1700 one more time though.

Here is the chart. You can see that most of the action since COVID has been in that 1680/2080 band, though there was a brief false break down to 1620 in late 2022. T-bills continue to be a better safe haven than gold, IMO, and if you have the patience to buy gold at 1700ish, that’s more attractive than HODLing here.

Gold daily chart back to 2018

Oil is still just totally gross. I don’t know what to say about it anymore. It should be ashamed of itself.

Alright. That was 6.9 minutes. You’re done. If you liked this week’s piece, please smash the like button. Or click it gently. Whichever.

Get rich or have fun trying.

Links of the week

A Trip

I did a tour of Ernest Hemingway’s house in Key West this week. If you’re a fan, it’s worth the trip. Here is a pic I took of his writing studio. This is where he wrote “For Whom the Bell Tolls” and a ton of other material.

Trailer for the new Mario sidescroller!

Herein, I doth link to mineself

https://twitter.com/donnelly_brent/status/1672243056593051648?s=20

Music

Jerry Cantrell comes to terms with his hardass Dad’s service in Vietnam.

“I was thinking about my dad; my folks got divorced when I was pretty young, so my dad wasn’t a big part of my teen years, but he was a badass and a hardass; he was an army sergeant, but I didn’t see a whole lot of him.

So when my mother had passed, he was my only parent left, and as I became a man, I started realizing I can’t be mad at him for, like, kid shit. Every kid’s mad at their dad for something.

I started to think about putting myself in his shoes and what he’d been through in his life, multiple tours in ‘Nam – just where he came from, things he had to deal with, and I started asking myself, ‘Would I have done any better? Could I have done any better?’…

And I couldn’t say yes, so that was kind of the first thing in me, kind of putting myself in his shoes, trying to take the blame off of him, and trying to make peace, and have a relationship with my dad again.

That was kind of a cool song for a lot of reasons. Personally, it was – I just described it, and then it actually happened, we started to become more pals and buddies and shit, and over the years we’ve grown closer and closer.

We built a ranch together about 20 years ago, and he’s still living on it and running it, in Oklahoma, and that song, in particular, means a lot to service members and their families.

Because I’m a family member of a service member, so it’s kind of taken on a life of its own. I’m glad that that song had the impact that it has. I didn’t have an intent for it to other than it being kind-of a pathway for my dad and I to have a better relationship, which worked.”

I hope people aren’t seriously using Tweets to diagnose Dunning Krueger. If so, I’m in big trouble.

Love Friday Speedrun! Thanks Brent!

Thank you so much for explaining the different inflation models. I hear people justifying their financial views with Truflation, but I personally experience much higher inflation in my own life on the east coast. Your explanation really helped. What will it take to ever increase the inventory in single family homes? Some sort of economic calamity of higher taxes that would make people with 3 and 4 single family homes as investments need to sale them? I feel like the shortage of inventory in real estate cannot last forever. But what will need to change, to make Invitation Homes and AirBnB landlords puke up all of the housing stock that they have hoarded.